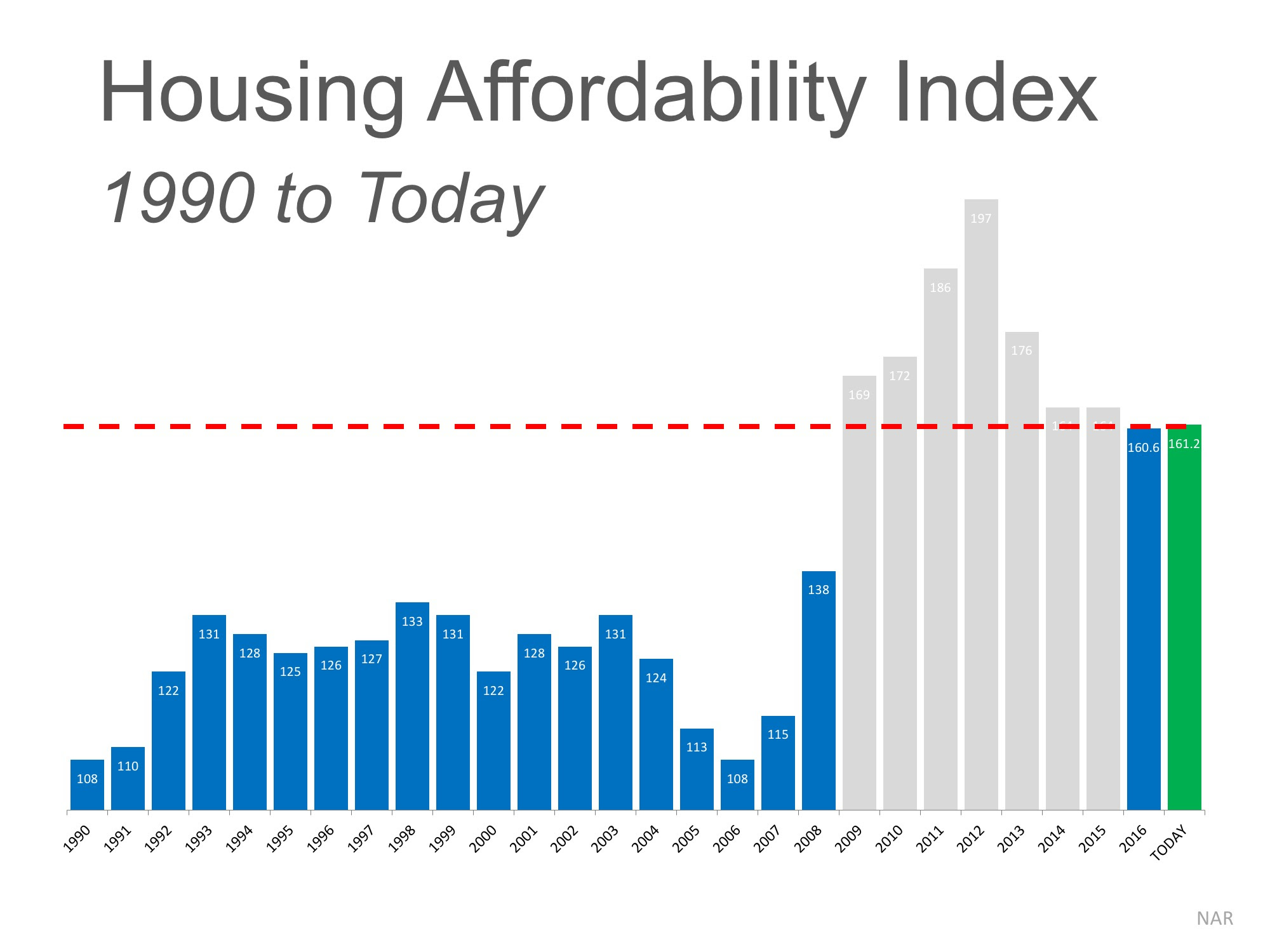

The REAL News about Housing Affordability: Some industry experts are claiming that the housing market may be headed for a slowdown as we proceed through 2017, based on rising home prices and a potential jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR).

Here is how NAR defines the index:

“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data.”

Basically, a value of 100 means a family earning the median income earns enough to qualify for a mortgage on a median-priced home, based on the price and mortgage interest rates at the time. Anything above 100 means the family has more than enough to qualify.

The higher the index, the easier it is to afford a home.

Why the concern?

The index has been declining over the last several years as home values increased. Some are concerned that too many buyers could be priced out of the market.

But, wait a minute…

Though the index skyrocketed from 2009 through 2013, we must realize that during that time, the housing crisis left the market with an overabundance of distressed properties (foreclosures and short sales). All prices dropped dramatically and distressed properties sold at major discounts. Then, mortgage rates fell like a rock.

The market is recovering, and values are coming back nicely. That has caused the index to fall.

However, let’s remove the crisis years (shaded in gray) and look at the current index as compared to the index from 1990 – 2008:

The “Real” News about Housing Affordability

Though prices and rates appear to be increasing, we must realize that affordability is composed of three ingredients: home prices, interest rates, and income. And, incomes are finally rising.

ATTOM Data Solutions recently released their Q1 2017 U.S. Home Affordability Index. The report explained:

“Stronger wage growth is the silver lining in this report, outpacing home price growth in more than half of the markets for the first time since Q1 2012, when median home prices were still falling nationwide. If that pattern continues, it will help turn the tide in the eroding home affordability trend.”

Bottom Line

Compared to historic norms, it is still a great time to buy from an affordability standpoint.

Six Tips To Sell Your Home Fast!

Six Tips To Sell Your Home Fast! Money is well spent on these six areas of your home to enhance the appearance and facilitate a quicker sale

How’s The Real Estate Market? Read What The Experts Are Saying

How’s The Real Estate Market? Read What The Experts Are Saying: “I am guessing we will see it get even better… If you are considering moving, it could be a

More Families Chose to Own a Home Than Rent in Q1

More Families Chose to Own a Home Than Rent in Q1. This marks the first time since 2006 that the number of new homeowner households outpaced the number of

When Is A Good Time To Rent A Home or Apartment?

When Is A Good Time To Rent A Home or Apartment? Regardless, we want to make certain that everyone understands that today is NOT a good time to rent.

5 Reasons Why You Should Use a REALTOR When Buying and Selling A Home

5 Reasons Why You Should Use a REALTOR When Buying and Selling A Home in your corner haven’t changed, but have rather been strengthened by the projections..

Why Americans Consider Moving To Another State

Why Americans Consider Moving To Another State. 41% would move for a “better job opportunity.” Being closer to loved ones filled out 3 of the top 6 reasons

Housing Shortage? The Answer is New Construction

Housing Shortage? The Answer is New Construction. A normal market would see a six-month supply of homes for sale. Currently, that number is below four…

We’re Influencing California State Legislation and Housing Affordability

We’re Influencing California State Legislation and Housing Affordability. It’s all about housing affordability in California. We along with 2,498 fellow…

4 Tips To Get Your Purchase Offer Accepted

4 Tips To Get Your Purchase Offer Accepted. So, you’ve been searching for that perfect house to call a ‘home,’ and you finally found one! The price is right, and in such a competitive market…

A Millennial’s Guide to Homeownership – FREE Download

A Millennial’s Guide to Homeownership. If you’re one of the millions of Millennials who’s seen their peers begin to buy homes recently and are wondering…

What You Need to Know About Qualifying for a Mortgage

What You Need to Know About Qualifying for a Mortgage. Many buyers are purchasing a home with a down payment as little as 3%.

Inventory Shortages Are Slowing Down the Market

Inventory Shortages Are Slowing Down the Market. It seems that 2017 will be the year that the housing market races forward again.

Is the Current Pace of Home Sales Maintainable?

Are we headed for another housing crisis? Actually, if we look closely at the numbers, we can see that we…

Homes are Selling Fast Across the Country

Homes are Selling Fast Across the Country. Homes sold in 60 days or less in 36 out of 50 states, and Washington D.C.

Kris and Kim Darney: Meet Our Raving Fans [Testimonials]

Kris and Kim Darney: Meet Our Raving Fans [Testimonials]

We are so blessed to have wonderful families and friends as REALTORS®. Sometimes we just have to say WOW! The families we’ve come to know and love through our time in real estate is the most rewarding part of our careers.

Slaying Home Buying Myths [INFOGRAPHIC]

Interest rates are still below historic numbers.

Tax Return Depressing? Owning a Home Could Help

Tax Return Depressing? Owning a Home Could Help

US Housing Market Continues Move into ‘Buy Territory’!

US Housing Market Continues Move into ‘Buy Territory’! The index examines the entire US housing market and then isolates 23 major cities for comparison.