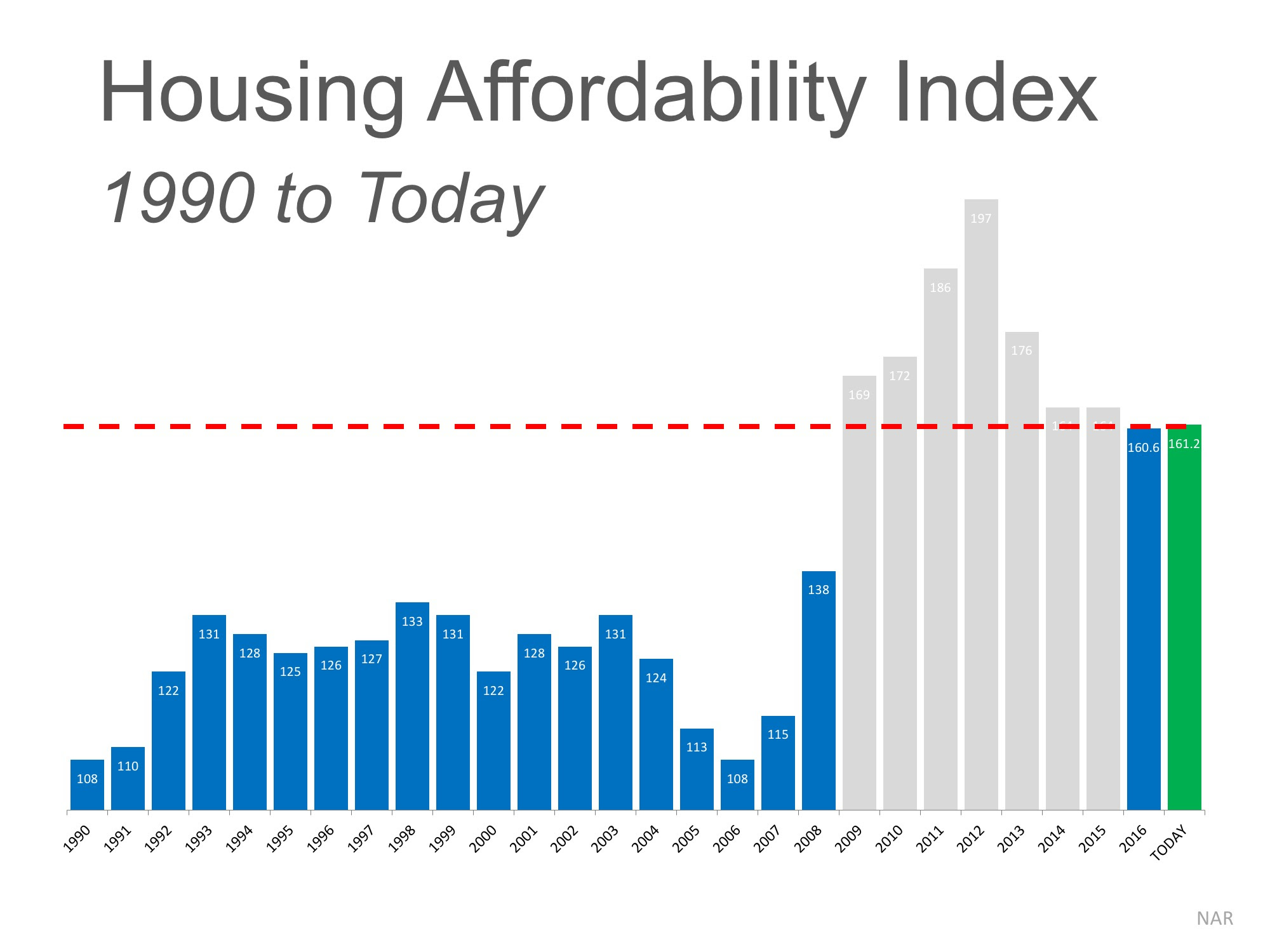

The REAL News about Housing Affordability: Some industry experts are claiming that the housing market may be headed for a slowdown as we proceed through 2017, based on rising home prices and a potential jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR).

Here is how NAR defines the index:

“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data.”

Basically, a value of 100 means a family earning the median income earns enough to qualify for a mortgage on a median-priced home, based on the price and mortgage interest rates at the time. Anything above 100 means the family has more than enough to qualify.

The higher the index, the easier it is to afford a home.

Why the concern?

The index has been declining over the last several years as home values increased. Some are concerned that too many buyers could be priced out of the market.

But, wait a minute…

Though the index skyrocketed from 2009 through 2013, we must realize that during that time, the housing crisis left the market with an overabundance of distressed properties (foreclosures and short sales). All prices dropped dramatically and distressed properties sold at major discounts. Then, mortgage rates fell like a rock.

The market is recovering, and values are coming back nicely. That has caused the index to fall.

However, let’s remove the crisis years (shaded in gray) and look at the current index as compared to the index from 1990 – 2008:

The “Real” News about Housing Affordability

Though prices and rates appear to be increasing, we must realize that affordability is composed of three ingredients: home prices, interest rates, and income. And, incomes are finally rising.

ATTOM Data Solutions recently released their Q1 2017 U.S. Home Affordability Index. The report explained:

“Stronger wage growth is the silver lining in this report, outpacing home price growth in more than half of the markets for the first time since Q1 2012, when median home prices were still falling nationwide. If that pattern continues, it will help turn the tide in the eroding home affordability trend.”

Bottom Line

Compared to historic norms, it is still a great time to buy from an affordability standpoint.

There’s More to a Bubble Than Rising Home Prices

What truly causes a housing bubble and the inevitable crash? For the best explanation, let’s go to a person who correctly called the last housing bubble – a year before it happened. “A bubble requires both overvaluation based on fundamentals and speculation. It is...

Want to Buy a New Home? Find New Home Builds in Los Angeles

Want to Buy a New Home? Find New Home Builds in Los Angeles, Orange, San Bernardino and Riverside Counties. The most up to date info in one search.

What If I Wait Until Next Year to Buy a Home?

As a seller, you will likely be most concerned about ‘short-term price’ – where home values are headed over the next six months. As a buyer, however, you must not be concerned about price, but instead about the ‘long-term cost’ of the home.

How Much More Equity In Your Home Over the Last Year?

Lower-priced homes have appreciated at greater rates than homes at the upper ends of the spectrum due to demand from first-time home buyers and baby boomers looking to downsize.

How Much Equity Do You Have In Your Home? You Will Be Surprised!

If you are one of the many Americans who is unsure of how much equity you have built in your home, don’t let that be the reason you fail to move on to your dream home in 2018! Let’s get together to evaluate your situation!

712,000 US Homes Moved Into Positive Equity in 2017

The average homeowner gained approximately $14,900 in equity during the past year. Compared to Q3 2016, negative equity decreased 22% from 3.2 million homes, or 6.3% of all mortgaged properties. U.S. homeowners with mortgages (roughly 63% of all homeowners) have seen their equity increase by a total of $870.6 billion since Q3 2016, an increase of 11.8%, year-over-year.

First Step To Buying A Home Is Getting Pre Approved

One way to show you are serious about buying your dream home is to get pre-qualified or pre-approved for a mortgage before starting your search.

The Cartier Experience

California Homes Days on Market Drops below 30 in October 2017

The National Association of REALTORS® surveyed their members for their Confidence Index.

Charts Don’t Lie About Housing Affordability

There’s a lot of discussion about the current state of housing affordability for both first-time and move-up buyers. Much of the narrative is tarnished with a negative slant.

Historically Speaking, There’s No Housing Bubble Coming Soon!

Historically Speaking, There’s No Housing Bubble! Let’s break this down. From 1975 to 1990, home values trended at standard 5% annual growth. In 1990, when the US entered into a recession, new construction prices fell.

Low Housing Inventory Results in Double Digit Price Increases

Low Housing Inventory Results in Double Digit Price Increases. If you are a first-time buyer or a seller thinking of moving up, waiting probably doesn’t make sense.

Buying A Home Or Renting, You’re Paying Someones Mortgage

As an owner, your mortgage payment is a form of ‘forced savings’. This allows you to build equity in your home. You can tap into this equity later in life if you choose. As a renter, you guarantee the landlord is the person with that equity.

Cooling Down and Home Buyers are Heating Up…Time To Sell

Each year, most homeowners wait until the spring to sell their houses because they believe that they can get a better deal during the normal spring buyer’s

1st Step To Buying a Home… Know Your Credit Score

Make sure all the information listed on your report is accurate and work to correct any mistakes.

Lack of Home Inventory Makes Now… Best Time To Sell

The inventory of homes for sale has fallen year-over-year for the last 28 months and has had an upward impact on home prices.

First Time Homebuyers Flocking to Our Down Payment Assistance Program

We’re sharing some very exciting news today for First Time Homebuyers! New California State Programs are making homeownership a reality for first time homebuyers. Owned a home in the past?

Buying A Home Costs Significantly Less Than Renting

Every market is different. Before you renew your lease again, find out if you can put your housing costs to work by buying this year!