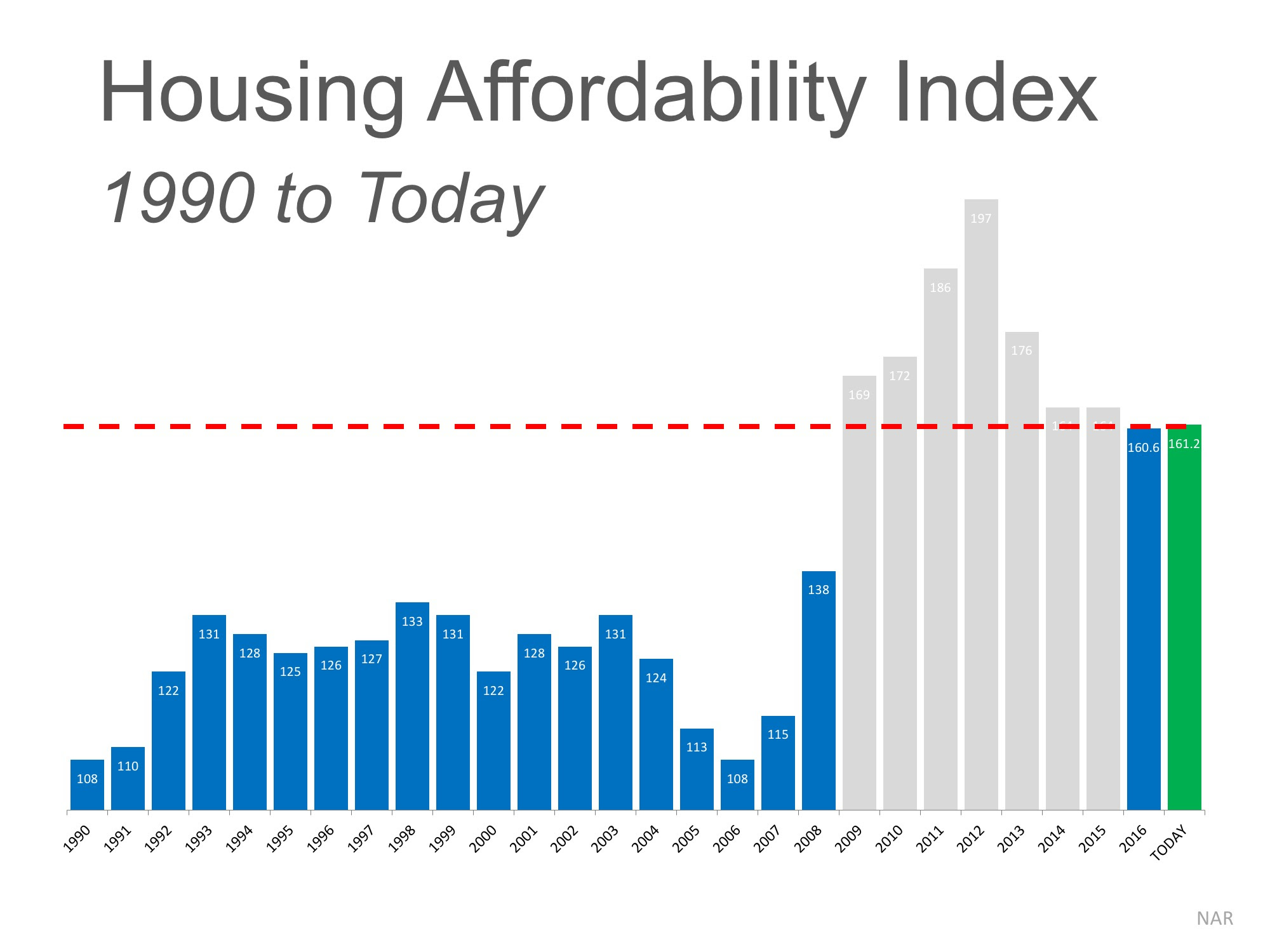

The REAL News about Housing Affordability: Some industry experts are claiming that the housing market may be headed for a slowdown as we proceed through 2017, based on rising home prices and a potential jump in mortgage interest rates. One of the data points they use is the Housing Affordability Index, as reported by the National Association of Realtors (NAR).

Here is how NAR defines the index:

“The Housing Affordability Index measures whether or not a typical family earns enough income to qualify for a mortgage loan on a typical home at the national level based on the most recent price and income data.”

Basically, a value of 100 means a family earning the median income earns enough to qualify for a mortgage on a median-priced home, based on the price and mortgage interest rates at the time. Anything above 100 means the family has more than enough to qualify.

The higher the index, the easier it is to afford a home.

Why the concern?

The index has been declining over the last several years as home values increased. Some are concerned that too many buyers could be priced out of the market.

But, wait a minute…

Though the index skyrocketed from 2009 through 2013, we must realize that during that time, the housing crisis left the market with an overabundance of distressed properties (foreclosures and short sales). All prices dropped dramatically and distressed properties sold at major discounts. Then, mortgage rates fell like a rock.

The market is recovering, and values are coming back nicely. That has caused the index to fall.

However, let’s remove the crisis years (shaded in gray) and look at the current index as compared to the index from 1990 – 2008:

The “Real” News about Housing Affordability

Though prices and rates appear to be increasing, we must realize that affordability is composed of three ingredients: home prices, interest rates, and income. And, incomes are finally rising.

ATTOM Data Solutions recently released their Q1 2017 U.S. Home Affordability Index. The report explained:

“Stronger wage growth is the silver lining in this report, outpacing home price growth in more than half of the markets for the first time since Q1 2012, when median home prices were still falling nationwide. If that pattern continues, it will help turn the tide in the eroding home affordability trend.”

Bottom Line

Compared to historic norms, it is still a great time to buy from an affordability standpoint.

Housing Inventory Hits 30-Year Low

Spring is traditionally the busiest season for real estate. Buyers, experiencing cabin fever all winter, emerge like flowers through the snow in search of their dream home.

93.9% Of Homes in The US Have Positive Equity

The outlook for 2017 remains positive as well, as an additional 600 thousand properties will regain equity if home prices rise another 5% this year.

20 Tips for Preparing Your House for Sale

Selling your home is a matter of competition in today’s real estate. You’re competing with other like minded sellers all fighting for the right offer at the right from an eager buyer.

Do Your Future Plans Include a Move? What’s Stopping You from Selling Now?

Do Your Future Plans Include a Move? What’s Stopping You from Selling Now? Are you an empty-nester? Do you want to retire where you are, or does a vacation

California Prop 60 and Prop 90 Property Tax Transfer Rates

California Prop 60 and Prop 90 Property Tax Transfer Rates

Home Buyer Demand Continues To Outpace Homes For Sale

Home Buyer Demand Continues To Outpace Homes For Sale. The price of any item is determined by the supply of that item, as well as the market demand.

Inventory Drops Again, Sales Slow

Inventory Drops Again, Sales Slow. Inventory of existing homes for sale dropped to a 4.3-month supply, marking the 25th month in a row of declines.

Americans Believe Real Estate is Best Long Term Investment

Americans who have money to set aside for the next 10 years would rather invest in real estate than any other type of investment.

11 Tips Sellers Need When The For Sale Sign Goes Up

11 Tips Sellers Need When The For Sale Sign Goes Up 11 Tips Sellers Need When The For Sale Sign Goes Up. The sellers have decluttered, painted, made repairs and spiffed up the landscaping. The curb appeal is at its best. After the long process of getting...

3 Tips to Succeed in Today’s Real Estate Market

3 Tips to Succeed in Today's Real Estate Market Here are 3 Tips to Succeed in Today's Real Estate Market. In today’s highly competitive real estate market, where inventory levels are not keeping up with the constant stream of buyer demand, there are steps...

Thinking of Selling? You Should Act NOW While Inventory Is Low

Thinking of Selling? You Should Act NOW While Inventory Is Low If you thought about selling your house this year, now more than ever may be the time to do it! The inventory of homes for sale is well below historic norms and buyer demand is skyrocketing. We...

3 Questions to Ask Before You Buy Your Dream Home

3 Questions to Ask Before You Buy Your Dream Home If you are debating purchasing a home right now, you are probably getting a lot of advice. Though your friends and family will have your best interests at heart, they may not be fully aware of your needs...

5 Benefits To Homeownership That Should Be At The Top Of Your List

5 Benefits To Homeownership That Should Be At The Top Of Your List 5 Benefits To Homeownership That Should Be At The Top Of Your List. Recently, Freddie Mac reported on the benefits of homeownership. According to their report, here are the five benefits...

Homeowners: Your Home Must Be Sold TWICE

Homeowners: Your Home Must Be Sold TWICE - Price To Sell In today’s housing market, where supply is very low and demand is very high, home values are increasing rapidly. Many experts are projecting that home values could appreciate by another 5%+ over the...

How Record Low Interest Rates Impact Your Home Purchasing Power

How Record Low Interest Rates Impact Your Home Purchasing Power According to Freddie Mac’s latest Primary Mortgage Market Survey, interest rates for a 30-year fixed rate mortgage are currently at 3.96%. This is still near record lows in comparison to...

5 Reasons Why You Should Not For Sale By Owner

5 Reasons Why You Should Not For Sale By Owner In today’s market, with home prices rising and a lack of inventory, some homeowners may consider trying to sell their homes on their own, known in the industry as a For Sale by Owner (FSBO). There are several...

Check This Out – Median Days on the Market Drops to 27

Check This Out - Median Days on the Market Drops to 27 Some Highlights: The National Association of REALTORS® surveyed their members for their monthly Confidence Index. The REALTORS® Confidence Index is a key indicator of housing market strength based on a...

Harvard Study: Epic Housing Shortage Being Reported

Harvard Study: Epic Housing Shortage Being Reported A Harvard study shows an epic housing shortage being reported. The Joint Center of Housing Studies (JCHS) at Harvard University recently released their 2017 State of the Nation’s Housing Study, and a...