Charts Don’t Lie About Housing Affordability

These Charts Don’t Lie About Housing Affordability! There’s a lot of discussion about the current state of housing affordability for both first-time and move-up buyers. Much of the narrative is tarnished with a negative slant. However, the truth is that housing affordability is better today than at almost any time in our history.

The naysayers are correct that affordability today is not as good as it has been over the last several years. But, we must remember that home prices collapsed during the housing crash, and distressed properties (foreclosures and short sales) kept home values depressed for years. When we compare affordability to the decades that proceeded the crash, a different story is revealed.

Here is a graph of the National Association of Realtors’ Housing Affordability Index. The higher the graph, the more affordable homes are.

Charts Don’t Lie About Housing Affordability

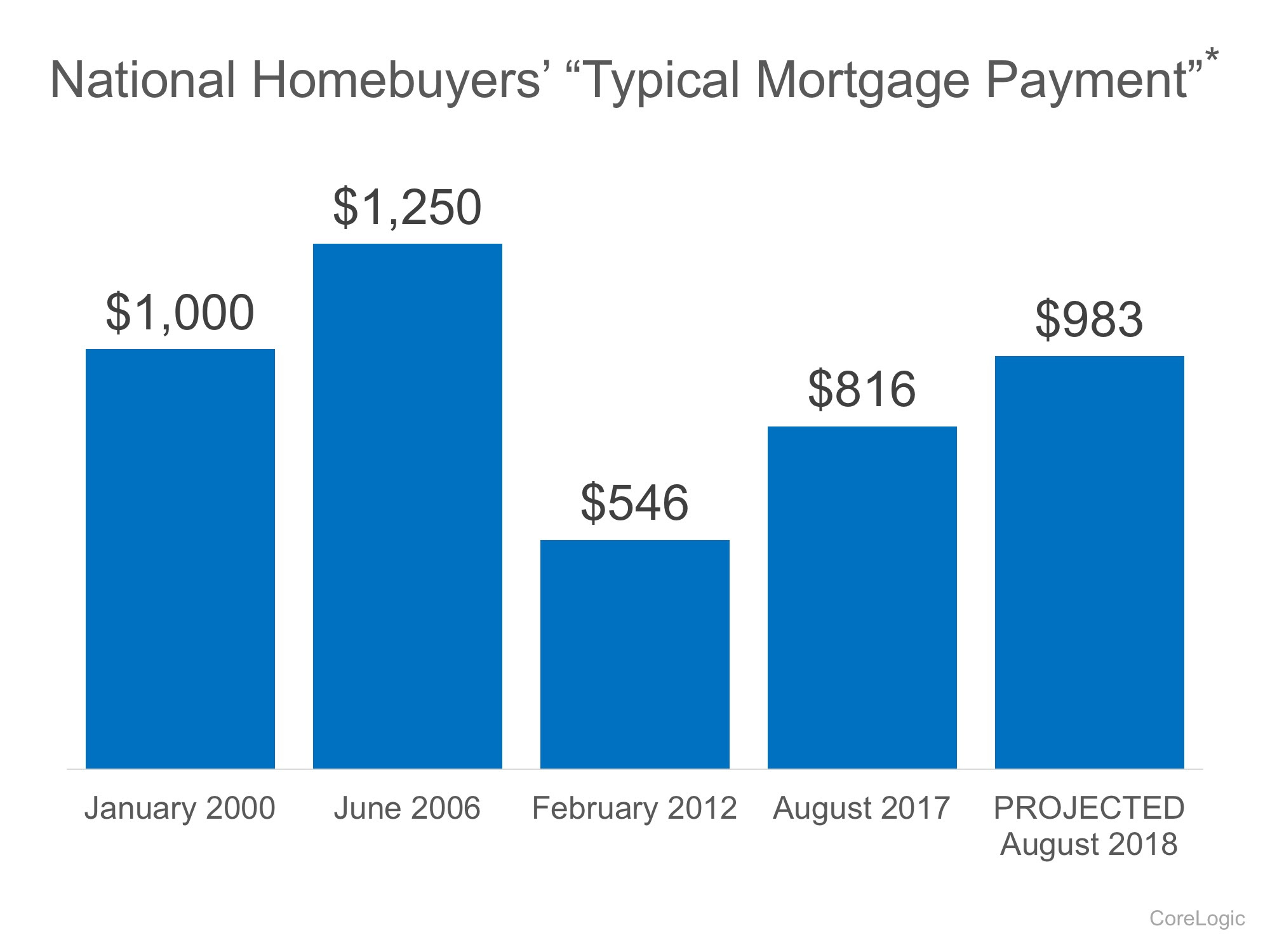

We can see that affordability is better today than in the fifteen years prior to the boom and bust. CoreLogic just published a report showing the National Homebuyers’ “Typical Mortgage Payment.” Here is a graph of their findings:  It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

Bottom Line

Mark Fleming, Chief Economist at First American, explained it best:

“While borrowing power for the potential home buyer has fallen relative to the low point of 2012, it remains high today and will remain high next year, relative to the long run average. If you don’t want to rent anymore and are considering becoming a homeowner, even if mortgage rates rise next year, your borrowing power will remain strong by historic standards.”

Call Us Now To Sell Your Home…

Office: 909.985.9392 or Text Us: 714.657.6634

Bank of America Foreclosure Moratorium! Happy Thanksgiving and Merry Christmas…More Short Sales?

This released from Bank of America... As the holidays approach, Bank of America will comply with applicable Holiday Moratorium requirements to avoid causing emotional distress to the occupants of a property. For this reason, foreclosures, evictions, relocation...

Linder's Furniture Going Out of Business! Collateral Damage?

We normally don't report on the retail furniture market...but this came a s a surprise as this was announced today....Linder's Furniture...a large retailer in the Southern California furniture landscape...announced it was closing it's doors after they complete...

Nearly Impossible To Make Mortgage Payments….Consider A Short Sale Instead Of Foreclosure

We've been getting lots of calls from homeowners recently. More and more people are taking a look at negative equity in their home and the fact its a struggle to pay the mortgage each month. According to recent data from U.S. Census Bureau the real median...

Short Selling Your Home…Leave a Bed in It!

One of our good friends and Short Sale Students Larry Bass from Denver, CO created this video...light in nature...but the information is great Short Sale Secret! Please watch and share http://www.foreclosureanswerman.com/fam069-a-foreclosure-and-a-bed/

California…Short Sale Your Home, Rent it and Buy it Back… www.ShortSellRentBack.com

Imagine... Short Sell your home that's underwater, get rid of the Negative Equity, Rent it back for up to 3 years...then buy it back minus all the negative equity? https://shortsalesellit.com/?page_id=1434 Contact Kris & Kim to learn more! 323-999-1822...

California at Bottom of National Homeownership Percentage with 55.9%

Interesting information on from DSNEWS.com about the nations homeownership percentages state by state. California tranked in the bottom 5 of the 50 United States...at 55.9%. The nations average is 66%...with West Virginia being at the top with 76.1% and Washington DC...

Bank of America Pushing Short Sales in their "Test" in Florida…Offering up to $20,000 Bounty

This breaking news from DS News... Bank of America is "testing" a short sale "test and learn" program in Florida with payments up to $20,000 to the succesful sale of a property sold via the Bank of America Short Sale program payable to the seller at close of...

Bank of America, JP Morgan Chase, Wells Fargo and Citi to Participate in HARP 2.0

Call it what it is...the only reason "the Big 4" are participating is to avoid hefty fines and punishment for selling "knowingly" bad loans to Fannie and Freddie... Of all the Government "Save our Housing" Programs... Home Affordable Refinance Program is probably the...

New and Improved HARP Home Affordable Refinance Program

The Federal Housing Finance Agency (FHFA) released details of a newly revamped Home Affordable Refinance Program(HARP) today, with the main feature being a lack of a loan-to-value (LTV) limit. Previously, the max LTV accepted under the program was 125 percent, meaning...

Short Sell and Rent Back My Home…I Need Help

Kim and I are on the short list of Real Estate Agents that are Certified under this US Government backed program... www.ShortSellRentBack.com If your a home owner or an Attorney, Broker or Agent wanting to learn more... Call us and we'll discuss next steps. Best,...

REO Sales Highest Through 2013…This Affirms Our thought on our Previous Blog

Funny...this affirms what we just blogged about in our last post...ROE's are outweighing everything and will continue to hold back market recovery. REO sales may not peak until 2013 Posted By JON PRIOR On October 17, 2011 @ 4:15 pm The sale of properties...

Bloomberg Reports that Short Sales May Drive Home Prices Up!

Interesting spin on Short Sales from Bloomberg Reports. Sounds optimistic, however, Bloomberg must not understand that the inventory of Pre Foreclosed homes exceeds the amount of short sales by 4 to 1...interesting read anyhow. Best...Kris By Kathleen M. Howley - Oct...

Los Angeles Home Sales … Foreclosures Lead Way…With Short Sales in 2nd

LA times reporting on Short Sales: California home sales picked up in September from the same month last year as prices came down. Sales were up 6.7% as bargain hunters paying cash snapped up foreclosures. Sales figures remained below the average for September in...

Is Your Bank Offering You CASH To Short Sale….Open All Of The Mail!

We know that your mail box is full of letters from your lender, but did you know that most lenders are reaching out to their clients with Snail Mail....offering Cash incentives to Short Sale? Here is a list of a few that we know of...stay tuned for updates as we get...

Short Sale…Rent…and Buy Back!

This may be an option for you... You can Short Sell your Home, Rent it Back and Buy it again in 1 to 3 years... without all the negative equity. Call us or email us to discuss. www.shortsellrentback.com 323-999-1822

Pawn Stars…Short Sales…Do You See The Similarity

Kris and I were talking yesterday about the usual...short sales and the economy. You would think that we could find something else to talk about! Our conversation started as we left a listing appointment. Imagine this...a nice, newer home surrounded by other nice...

The Vanishing Home Buyer…

Need Short Sale Advice…Before You List The Home

Did you know that Real Estate Agents do not get paid for their services if the "deal" or "transaction" or "Sale" does not happen? You ask...so...why do I care? I believe it's important for you to understand, we all have a job to do and at the end of that job we need...