93.9% Of Homes in The US Have Positive Equity

93.9% Of Homes in The US Have Positive Equity. CoreLogic’s latest Equity Report revealed that ninety-one thousand residential properties regained equity in Q1 2017. The outlook for 2017 remains positive as well, as an additional 600 thousand properties will regain equity if home prices rise another 5% this year.

The study also revealed that:

- Roughly 63% of all homeowners have seen their equity increase since Q1 2016

- The average homeowner gained about $14,000 in equity between Q1 2016 and Q1 2017

- Only 1.6% of residential properties are near-negative equity

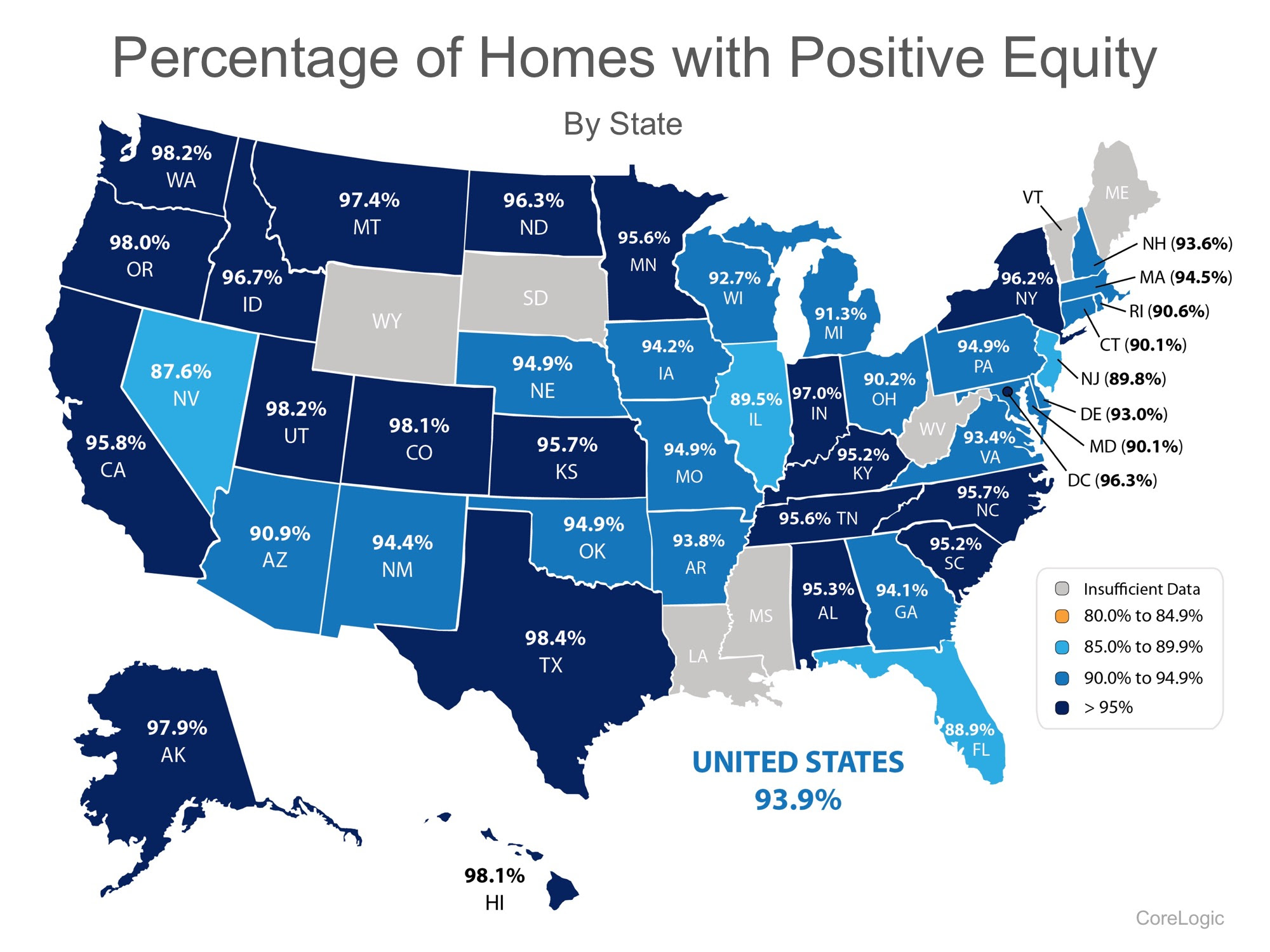

Below is a map showing the percentage of homes with a mortgage, in each state, that have positive equity. (The states in gray have insufficient data to report.)

93.9% Of Homes in The US Have Positive Equity

Significant Equity Is On The Rise

Frank Martell, President & CEO of CoreLogic , believes this is great news for the “long-term health of the U.S. economy.” He went on to say:

“Homeowner equity increased by $766 billion over the last year, the largest increase since Q2 2014. The rising cushion of home equity is one of the main drivers of improved mortgage performance. Since home equity is the largest source of homeowner wealth, the increase in home equity also supports consumer balance sheets, spending and the broader economy.”

93.9% Of Homes in The US Have Positive Equity

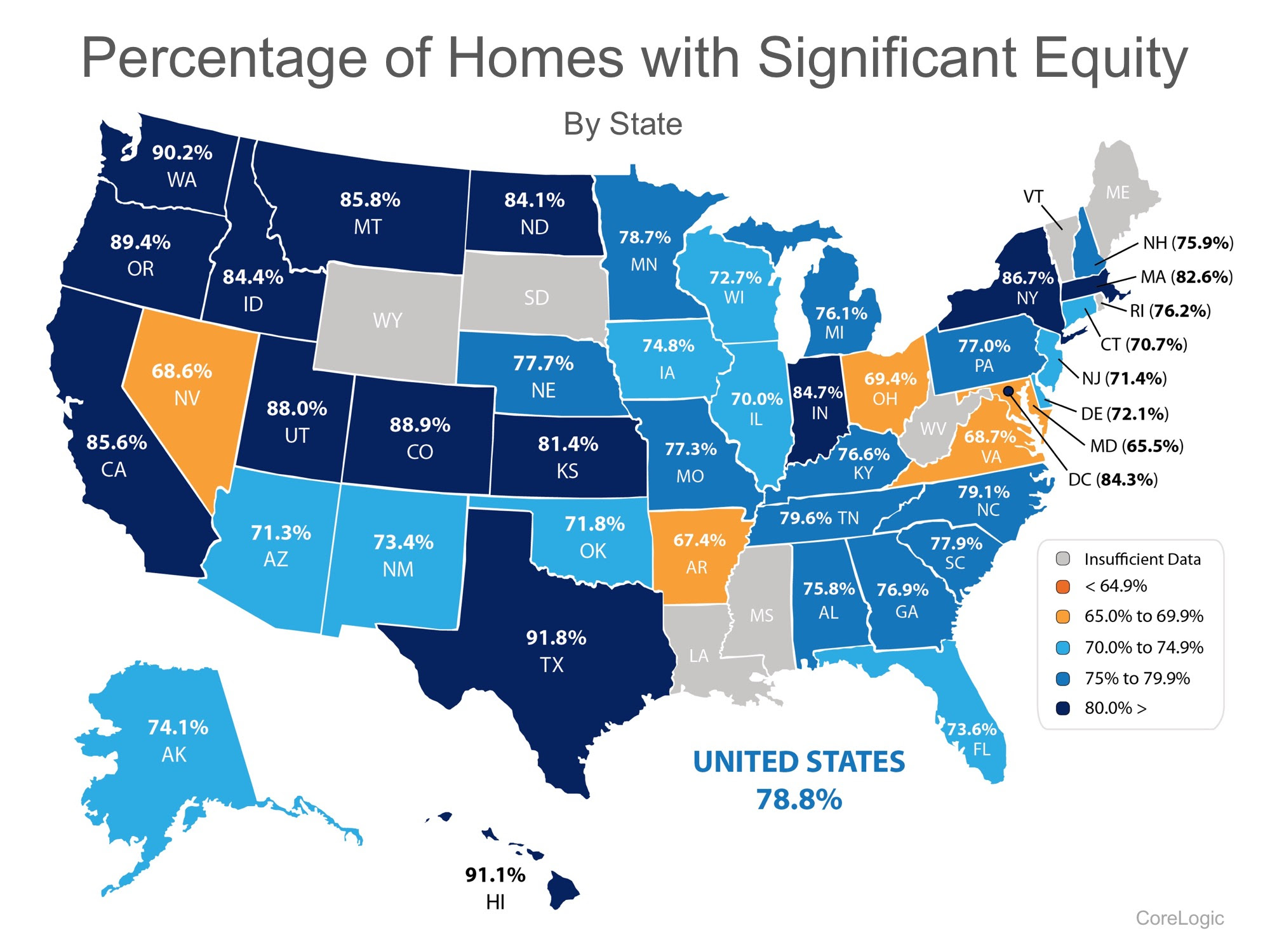

Of the 93.9% of homeowners with positive equity in the US, 78.8% have significant equity (defined as more than 20%). This means that nearly three out of four homeowners with a mortgage could use the equity in their current home to purchase a new home, now .

The map below shows the percentage of homes with a mortgage, in each state, that have significant equity. (The states in gray have insufficient data to report.)

93.9% Of Homes in The US Have Positive Equity

Bottom Line

If you are one of the many homeowners who are unsure of how much equity they have in their homes and are curious about their ability to move, let’s meet up to evaluate your situation.

Call Us Now To Sell Your Home…

Office: 909.985.9392 or Text Us: 714.657.6634

Home Mortgages: Rates Are Up And Requirements Easing

Home Mortgages: Rates Are Up And Requirements Easing. The media has extensively covered the rise in mortgage interest rates since last fall

Millennials Flock to Low Down Payment Programs

Millennials Flock to Low Down Payment Programs. Among millennials who purchased homes in January, FHA loans remained popular, making up 35% of all loans closed

Careful…Don’t Get Caught in the Rental Trap

Careful…Don’t Get Caught in the Rental Trap. There are many benefits to homeownership. One of the top benefits is being able to protect yourself from…

Why it’s Important To Hire A REALTOR To Sell Your Home

Why it’s Important To Hire A REALTOR To Sell Your Home. When a homeowner decides to sell their house, they obviously want the best possible price for it with the least amount of hassles. However, for the majority of sellers, the most important result is getting their homes sold.

The REAL News about Housing Affordability

Some industry experts are claiming that the housing market may be headed for a slowdown as we proceed through 2017, based on rising home prices and a potential jump in mortgage interest rates.

Spring 2017 – Buying A Home? Be Prepared Fo Bidding Wars

Spring 2017 – Buying A Home? Be Prepared Fo Bidding Wars. Traditionally, spring is the busiest season for real estate. Buyers come out in force and homeowners list their houses for sale hoping to capitalize on buyer activity.

Buy A Home Now With Less Than 20% Down Payment

There are two major misconceptions that we want to address today.

Soaring Consumer Confidence for Economy and Housing

The success of the housing market is strongly tied to the consumer’s confidence in the overall economy. For that reason, we believe 2017 will be a great year for real estate. Here is just a touch of the news coverage on the subject.

California Home Prices Up 6.6% Last Quarter

California Home Prices Up 6.6% Last Quarter. California outpaced national home price increase of 6.15%.

Considering a Luxury Home? Now’s The Time!

Considering a Luxury Home? Now’s The Time! If your house no longer fits your needs and you are planning on buying a luxury home, now is a great time…

Things To Consider When Selling Your House – Spring 2017

Things To Consider when Selling Your House – Spring 2017 …Here are five reasons listing your home for sale this spring makes sense.

1. Demand Is Strong

Happy Birthday Kim!

Wishing you the best day of your life. Let’s celebrate like no other. You are the light of my life. Hugs and kisses.

4 Reasons To Buy Your Home This Spring

4 Reasons To Buy Your Home This Spring. 1. Prices Will Continue to Rise

CoreLogic’s latest Home Price Index reports that home prices have appreciated by 6.9% over the last 12 months.

Best Month and Day to List Your Home

Best Month and Day to List Your Home? This is a long sight after question in the competitive real estate market place today. Per this study by

Is Your Luck Running Out In Buying A Home?

Is Your Luck Running Out In Buying A Home? Freddie Mac predicts that interest rates will increase to 4.8% by this time next year…

Which Homes Have Appreciated the Most?

Which Homes Have Appreciated the Most? Home values have risen dramatically over the last twelve months. The CoreLogic report broke down appreciation even…

Tale of Two Markets: Inventory Mismatch Paints a More Detailed Picture

The inventory of existing homes for sale in today’s market was recently reported to be at a 3.6-month supply according to the National Association of Realtors

Connection Between Home Prices and Family Wealth

The Connection Between Home Prices and Family Wealth. Over the next five years, home prices are expected to appreciate 3.22% per year on average and to grow by 17.3% cumulatively, according to Pulsenomics’ most recent Home Price Expectation Survey. So, what does this...