Over Half of All Buyers Are Surprised by Closing Costs

After surveying 1,000 first-time and repeat homebuyers, the results revealed that 17% of homebuyers were surprised that closing costs were required at all. Another 35% were stunned by how much higher the fees were than expected. Over Half of All Buyers Are Surprised by Closing Costs

Over Half of All Buyers Are Surprised by Closing Costs

“Homebuyers reported being most surprised by mortgage insurance, followed by bank fees and points, taxes, title insurance and appraisal fees.”

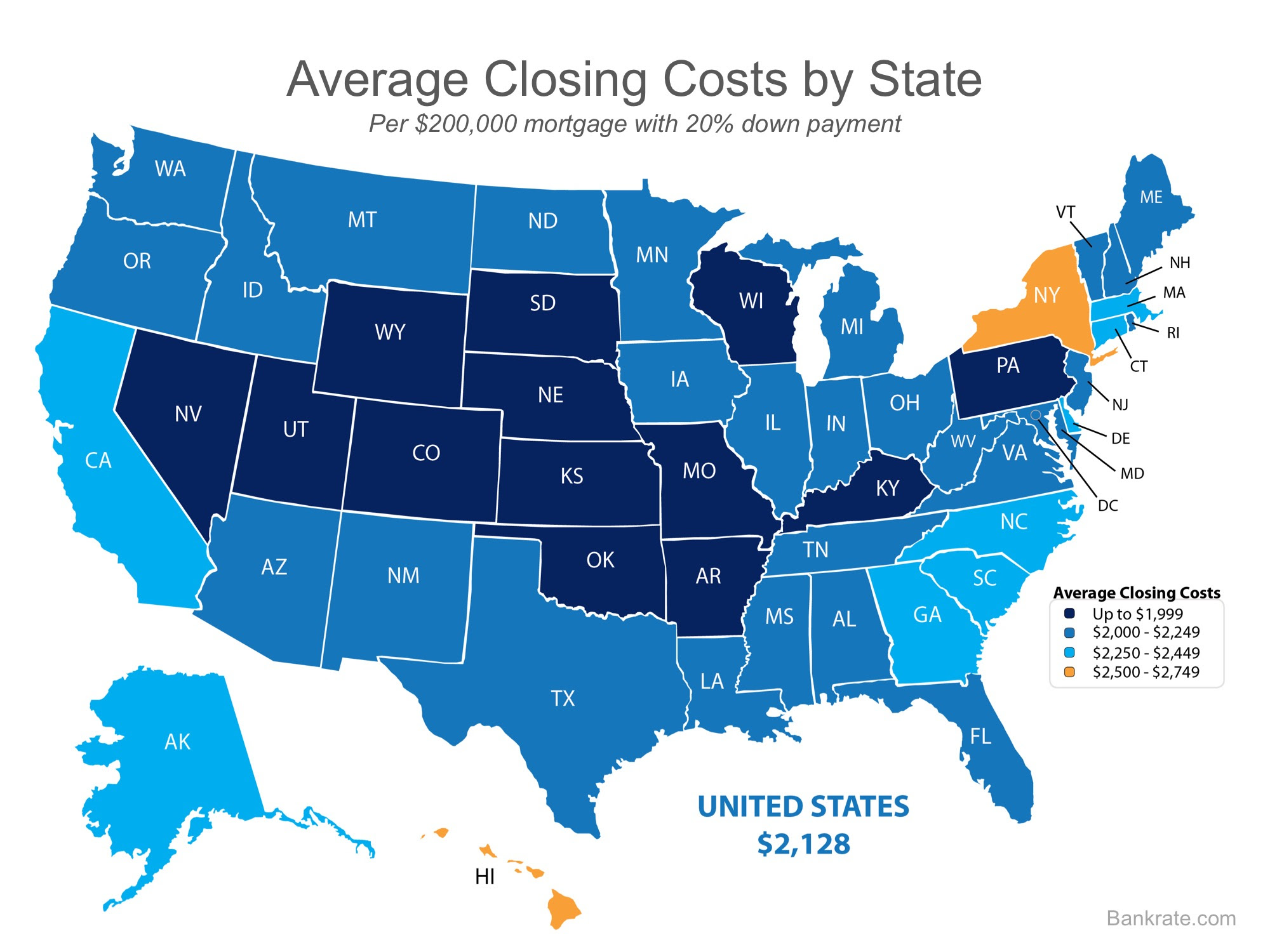

Bankrate.com recently gathered closing cost data from lenders in every state and Washington, D.C. to be able to share the average costs in each state. The map below was created using the closing costs on a $200,000 mortgage with a 20% down payment.

Keep in mind that if you are in the market for a home above this price range. your costs could be significantly more. According to Freddie Mac,

“Closing costs are typically between 2 and 5% of your purchase price.”

Bottom Line

In conclusion, speak with your lender and agent to determine how much money you’ll need at closing. Finding out that you’ll need to come up with thousands of dollars right before closing is not a surprise anyone wants.

California Residents: 140% or more Underwater…CalHFA to the Rescue

Today, CalHFA announced an exciting new change to their Principal Reduction Program, recognizing aloan-to-value ratio of 140% or higher as a “financial hardship.”

Fannie Mae Finds Fix for Incorrect Credit Reporting of Short Sales…Buy Sooner

Fannie Mae Fixing Their Wrong Credit Reporting for Short Sales

RE Brokers or Agents Not Allowed to Represent Both Seller & Buyer on FHA Short Sale

Housing and Urban Development (HUD) just released updates to Pre-Foreclosure Sales (PFS) or Short Sales for FHA backed mortgages. What does this mean? If you list your FHA backed mortgage for short sale, your listing broker or agent may not represent the buyer as...

Forbes 400 Worth How Much?

According to new research from Forbes, The 400 richest people in the U.S. are now worth a record total of $2 trillion. Entry into this prestigious group starts at a net worth of $1.3 billion, while the average net worth of the group is $5 billion. Topping the 400...

Look Up for Changes!

While ceiling decor might not be the first thing you think about when designing a house, ceilings are a great way to create space or add a focal point. Whether you are dreaming about remodeling a kitchen or an indoor pool, there are endless style options for homeowners looking to add some extra pizazz to the space above their heads.

2.3 Million California Homeowners Are “Almost” or Completely Underwater as of July 2013

Recent numbers place California in the same state of affairs it was just 6 months back! Roughly 6.8 Million SFR mortgages of which 2.3 million are close to or are clearly underwater. A rise in interest rates could throw this number even further into the red…which, is likely to happen over the next few months…above the 5% level! :/

Housing Bubble…Short Sales…Zombie Foreclosures…2014 will be interesting!

Summer Trends Point to another housing bubble

California Short Sale Relocation Program Offers $5,000 to Complete A Short Sale

Great News for those of us in the Golden State.

“There’s Gold in them their short sales!”

Yes…State fo California through CalHFA, is offering up to $5000 to 460 homeowners in CA to complete a short sale successfully.

FHA Back to Work Lending Guidelines: Repurchase 12 Months After Short Sale

What we have been waiting for: FHA announces Re-Purchase Program 12 Months after SHORT SALE.

Eligibility Requirements:

Experienced and Economic Event… (Vague? Most homeowners have been hit with an unforeseen economic hardship)

Must Be Fully Recovered… (You’ve been employed and making money for the last 12 months and your credit reflects your recovery)

Complete HUD Housing Counseling… (Pretty simple…takes an hour or so and you receive a certificate)

Reduction of 20% of your income Due To The Economic Event… (In our experience, this is representative of 90% of the homeowners that have short sold their homes)

Homeowners… are you Distressed Out? Listen & Hear!

Our latest podcast with Larry Bass... ForeclosureAnswerMan.com out of Colorado. Listen, Learn and share with your friends and family in need:

FHA Breaking News…Buy a Home 12 months after Short Sale

Fantastic news from FHA. Just released, If you completed a short sale and it's been over 12 months, you may qualify for a new mortgage loan! Easy guidelines to meet, if you had a hardship, then simply have the documentation to back it up. The Federal Housing...

HAFA Short Sale Extended Through December 31, 2015

Breaking News: Just announced today... Government sponsored Making Homes Affordable HAMP and HAFA programs have been extended through December 31, 2015. Here is the Supplemental Directive 13-04 announcing: sd1304

HAMP and HARP Gets Extended for an Additional 2 Years…More Short Sales

Great News! 2 of the governments distressed homeowners assistance programs have been extended for an additional 2 years, through December 2015. The HAMP program floundered at first, however, with governmental pressures on the banks and services, to promote the HAMP...

Shadow Inventory…Short Sales…FHA…Wow!

Take a minute or two and read this article! Make sure to pay special attention to the new "servicer" requirements on these bad loans once repurchased. Servicers must be purchasing at some extraordinary prices to agree to hold the home from foreclosure for a minimum...

Wells Fargo…Current Spike in Home Prices…”Bubble within a Bust”, More Short Sales

By now you've probably heard that home prices are rising...at high rates, some even cracking the double digit rates! Ask yourself, How and Why? Easy answer...the banks (servicers) are at it again. By not pursuing foreclosure process on homeowners that don't pay, the...

Jane Armstrong, Las Vegas Broker Highlighted on CNBC Power House

Jane Armstrong, one of our Short Sale Graduate Students with Harris University... Congratulations for this great expose' on CNBC and sharing your inside knowledge...watch this video...

Fannie Mae Forcing Foreclsoure to Make More Money…Short Sale Sabotage?

Just reported today from We The People.com... It appears that Fannie Mae, the Government Subsidized Entity (GSE) is gouging homeowners in trouble with a standardized decree to request a minimum of 20% more than market value...on their Fannie Mae backed short sales....

California Homeowners: Changes to Laws on Foreclosure…Short Sale is the Answer!

California Court of Appeals (4th District) overturned CCP 580d as it pertains to protecting homeowners that choose foreclosure over Short Sale. California law "protected" homeowners that chose foreclosure as an alternative if the lenders that were foreclosed on 1st...