Over Half of All Buyers Are Surprised by Closing Costs

After surveying 1,000 first-time and repeat homebuyers, the results revealed that 17% of homebuyers were surprised that closing costs were required at all. Another 35% were stunned by how much higher the fees were than expected. Over Half of All Buyers Are Surprised by Closing Costs

Over Half of All Buyers Are Surprised by Closing Costs

“Homebuyers reported being most surprised by mortgage insurance, followed by bank fees and points, taxes, title insurance and appraisal fees.”

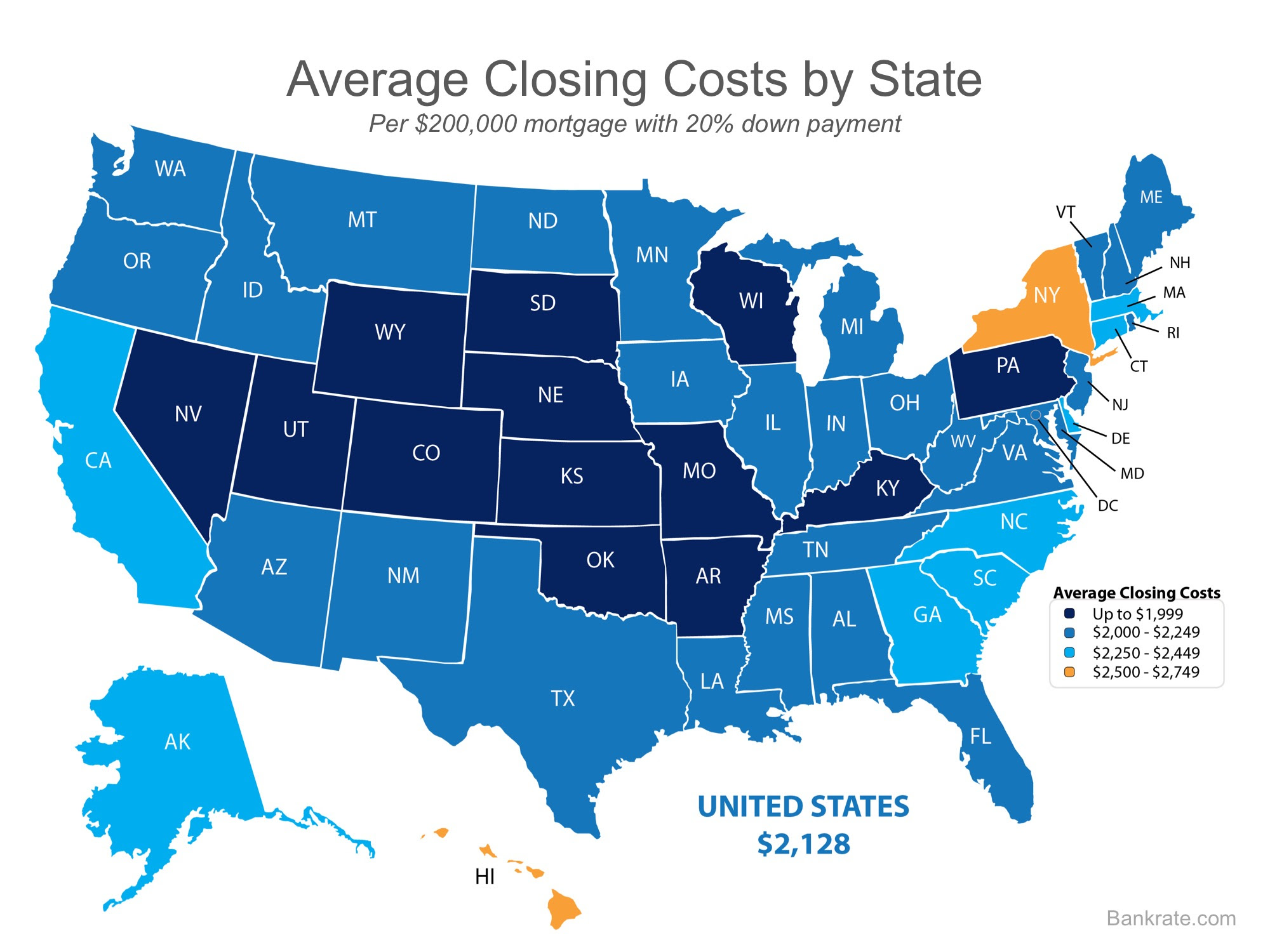

Bankrate.com recently gathered closing cost data from lenders in every state and Washington, D.C. to be able to share the average costs in each state. The map below was created using the closing costs on a $200,000 mortgage with a 20% down payment.

Keep in mind that if you are in the market for a home above this price range. your costs could be significantly more. According to Freddie Mac,

“Closing costs are typically between 2 and 5% of your purchase price.”

Bottom Line

In conclusion, speak with your lender and agent to determine how much money you’ll need at closing. Finding out that you’ll need to come up with thousands of dollars right before closing is not a surprise anyone wants.

Los Angeles County Real Estate Statistics for March 2014

March 2014 Real Estate Activity Statistics for Los Angeles County: Total Single Family Residence (SFR) Sold/Closed: 3,634 Total SFR Distressed Sales (NOD, In-Forclosure, Short Sale) 326 Total Real Estate Owned (REO) 136 Total Probate 75 Fun Fact: Most Expensive Los...

Mortgage Debt Forgiveness Relief Act Extension Approved by Senate

Great news from NAR on the government approving an extension to the Mortgage Debt Forgiveness Relief Act of 2007.

The Mortgage Debt Forgiveness Relief Act protects the homeowner from taxation on their short sale of their primary residence.

Of course, California residents are protected from this type of taxation under CCP580E.

Chino Hills Housing Statistics

Chino hills California current housing statistics. Is it time to sell?

What is Probate?

What is probate? We answer this question here: https://shortsalesellit.com/probate-questions/ We invite your specific questions Probate, Guardianship or Conservatorship...

Paint Your Home! What To Consider When Choosing A Color.

While it’s a good idea to get creative, it’s usually a bad idea to pick colors that will clash with your neighbors’ exteriors. You can always stand out but try to do so in an unobtrusive way!

The Real Wolf of Wall Street Finally Gets Punished!

It’s about time! Former CEO of Bank of America Ken D. Lewis is given his “sentence” for instrumenting the greatest financial crisis in US history. 5 years after leaving BofA on his Platinum Parachute ($135,000,000.00) “retirement” package, the smoke has cleared?

A Tiny House is not always cheap house…Like Short Sale is not really quick!

We have several friends that are considering downsizing. Who really needs all that "stuff" anyway? Check this out! With high rents in several parts of the country, it’s not uncommon to find apartments measuring under 500 square feet. According to tiny housing...

HAMP Loan Mod Re-Refaults on the Rise!

Loan Mod re-defaults are on the rise across the US. This map is expected to see an increase of 30% loan mod failure. Do you need help?

Suspicious? JPMorgan CHASE Executives are Turning Up Dead

We're not big conspiracy theorists, however, this is right out of a crime novel. Why has this not made the evening news? JP Morgan admitting knowing all about and supporting Bernie Madoff's scheme...what else are they hiding? Below is an article scraped from Housing...

The Types of People That Attend Open Houses

1. The real buyer

These people are somewhere in the home-buying process. They’re either testing out the market or they’re serious and fully qualified, ready to take action. For the seller, these are the ones you want coming through the door.

Why Do Short Sales Take So Long?

In a short sale, you need the seller’s bank to approve before you can close. Banks require dozens of pages of paperwork to evaluate whether or not to approve a short sale. Since the seller is asking the bank to accept a sale price that’s less than the mortgage amount, the bank needs to verify that a short sale is the right thing to do. Banks want to make sure the seller is indeed unable to stay in the home and can’t afford to pay off the difference between the market value and the bank’s loan amount.

Designer Ed Hardy Asking $3.199M for LA Tudor

According to the Los Angeles Times, the Mid Wilshire area abode was purchased by the creator of the Ed Hardy brand in 2007 for $2.695 million. Since then, Audigier sold his design company for $62 million and made several attempts to lease this 5,400-square-foot property.

Grant Deed vs. Quit Claim Deed

ransferring ownership of a property in California is accomplished via a property deed. There are at least a dozen different standard deeds, all developed over time to address different circumstances. These...

Californians: IRS and CA FTB Confirm No Taxes for Short Sales Due to CCP 580E

It's official according to the California Association of Realtors (CAR). As expected, the announcement earlier this month from the IRS courtesy of CAR and Senator Barbara Boxer, the IRS will consider any short sale taxable shortages (1099) for California homeowners...

Over 40% of all mortgages underwater…Short Sales…Foreclosure…Recovery?

Here it is comes, 2014, just a few weeks away...can you believe it? I find myself wondering what 2014 will bring? With recent numbers released by housing forecasters of over 40% of homeowners with mortgages being underwater I have to ask what is really going...

Do you have a mortgage with Chase Bank? May want to Short Sale Soon

If you have a mortgage thats underwater and Chase holds the note, be on the look out for the loan to be sold to Ocwen or another servicer. November 1st is the date slotted for Chase to unload....so....if you are late on payments there is a very good chance the...

Breaking news: California Short Sales are Not Subject to IRS Tax Deficiencies

California Association of realtors and California Senator Barbara Boxer received a letter from the IRS that clearly spell out the due to California's protective laws for distressed homeowners, that the Internal Revenue Service will not pursue tax deficiencies on short...

Riverside and San Bernardino County Rank in the Top 5 Foreclosure Rates

Among the nation’s 20 largest metro areas, the highest foreclosure rates were in Miami, Tampa, Chicago, Baltimore, and Riverside-San Bernardino, California.