Charts Don’t Lie About Housing Affordability

These Charts Don’t Lie About Housing Affordability! There’s a lot of discussion about the current state of housing affordability for both first-time and move-up buyers. Much of the narrative is tarnished with a negative slant. However, the truth is that housing affordability is better today than at almost any time in our history.

The naysayers are correct that affordability today is not as good as it has been over the last several years. But, we must remember that home prices collapsed during the housing crash, and distressed properties (foreclosures and short sales) kept home values depressed for years. When we compare affordability to the decades that proceeded the crash, a different story is revealed.

Here is a graph of the National Association of Realtors’ Housing Affordability Index. The higher the graph, the more affordable homes are.

Charts Don’t Lie About Housing Affordability

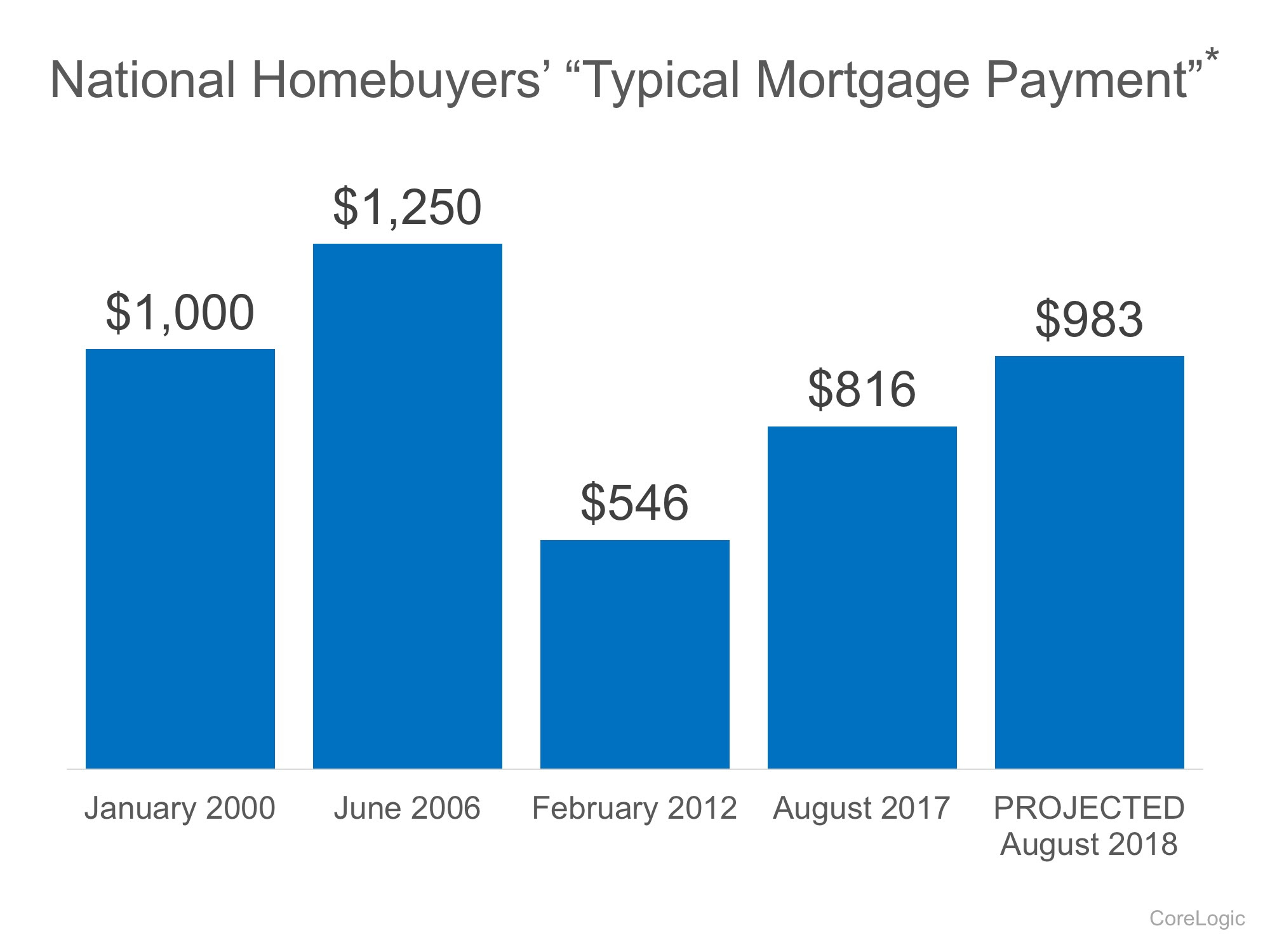

We can see that affordability is better today than in the fifteen years prior to the boom and bust. CoreLogic just published a report showing the National Homebuyers’ “Typical Mortgage Payment.” Here is a graph of their findings:  It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

Bottom Line

Mark Fleming, Chief Economist at First American, explained it best:

“While borrowing power for the potential home buyer has fallen relative to the low point of 2012, it remains high today and will remain high next year, relative to the long run average. If you don’t want to rent anymore and are considering becoming a homeowner, even if mortgage rates rise next year, your borrowing power will remain strong by historic standards.”

Call Us Now To Sell Your Home…

Office: 909.985.9392 or Text Us: 714.657.6634

$56Million, 112 Acres, Brentwood, CA …Actually a Steal

Robert Taylor Ranch Listed for $56 Million How can we say a "a steal"? Brentwood, CA is one of the most expensive zip codes in the US and high ranking in the world. When you consider that the average home in this part of Beverly Hills, Holmby Hills, etc... will sell...

It's Official…New Buyers Must Meet June 30 Close Deadline to Get Tax Credit

It seems our illustrious government representatives can't find a common ground to on which to meet...what's new? With the recent defeat of HR 4213 on The Hill...it leaves an uncertain feeling in the mouths of buyers that are trying to take advantage of the $8,000.00...

Nixon’s Former San Clemente, California Estate Gets Another Price Cut

It appears that not even the title of The President of The United States can salvage an offer in todays Southern California home market. This exquisite example of a Spanish Revival...predominant on So Cal's Gold Coast during the 1920's and '30's...wreaks of a relaxed...

Charlize Theron Renting Her Malibu Beach House for $50,000/Month

I'm wondering if the home is a beautiful as she is? For the price of a brand-new car, you can rent a home in Malibu. It’s not just any Malibu home, but the home of actress Charlize Theron. The South Africa native is renting it out for $50,000 per month, according to...

What? Prisoners Buying Homes And Getting Tax Credit!

Home Tax Credit….Dead…No Extension

The proposal was simple and necessary: Extend the closing date for the home buyer tax credit from June 30th to September 30th — not the tax credit itself, which required buyers to sign a contract by April 30th, just the closing date. Anybody who has ventured into the...

Fannie Mae To Penalize Walk Aways…Better Known As Foreclosure!

Pull Back On Housing? CEO Of Redfin and Others Are….

How often to you hear a real estate broker bash housing? For me it's twice in two days. I had a chance today to sit down this morning, via satellite, with the CEO of online real estate brokerage Redfin, Glenn Kelman, who is one of the few people actually making money...

Consumer Spending Up…Paying Mortgages Down…Strategic Short Sales

The numbers are telling us some crazy things... It seems that Americans are placing themselves in a unique conundrum. With housing prices continuing to drop, many Americans are turning to loan mods and short sales to reduce their liabilities. As many are aware,...

Home Sales Tumble In May..Tax Credit Gone So Are Buyers

Sales of previously owned homes fell unexpectedly in May as delays in processing mortgage applications hampered the closing of contracts benefiting from a popular homebuyer tax credit, an industry group said on Tuesday. The National Association of Realtors said sales...

Double Dip In Housing Will Cause Slow Economic Recovery

The US economy faces a perilous second half as a new set of problems hits real estate and thwarts any chance for a strong recovery, banking analyst Meredith Whitney told CNBC. cnbc.com Meredith Whitney While stopping short of predicting a full-blown double dip in the...

Sergei Fedorov Selling His Detroit Mansions on Short Sale

Sergei Fedorov, better known for scoring hat tricks than missing mortgage payments, is facing foreclosure on two of his Michigan mansions. The ex-Red Wings star owes more than $2 million on two Bloomfield Hills properties, according to Detroit News. The PrivateBank...

As Loan Mods Fail Banks Accept More Short Sales To Avoid Foreclosures

HAMP Program Falling Flat..155,000 Borrowers Left Program Last Month!

WASHINGTON — The Obama administration's flagship effort to help people in danger of losing their homes is falling flat. More than a third of the 1.24 million borrowers who have enrolled in the $75 billion mortgage modification program have dropped out. That exceeds...

End of Your Emotional Rope! Strategic Short Sale

This is a video from CNN that is beating up this guy about his decision to do a Strategic Short Sale. However, this homeowner "investor" is right! Morally wrong? Is it morally wrong for banks to default on their properties? or is it a business decision? The last 4...

Some Fun Facts…We All Need A Break From Short Sales!

Interesting and Fun Facts: In the 1400's a law was set forth in England that a man was allowed to beat his wife with a stick no thicker than his thumb. Hence we have 'the rule of thumb' Many years ago in Scotland , a new game was invented. It was ruled 'Gentlemen...