Charts Don’t Lie About Housing Affordability

These Charts Don’t Lie About Housing Affordability! There’s a lot of discussion about the current state of housing affordability for both first-time and move-up buyers. Much of the narrative is tarnished with a negative slant. However, the truth is that housing affordability is better today than at almost any time in our history.

The naysayers are correct that affordability today is not as good as it has been over the last several years. But, we must remember that home prices collapsed during the housing crash, and distressed properties (foreclosures and short sales) kept home values depressed for years. When we compare affordability to the decades that proceeded the crash, a different story is revealed.

Here is a graph of the National Association of Realtors’ Housing Affordability Index. The higher the graph, the more affordable homes are.

Charts Don’t Lie About Housing Affordability

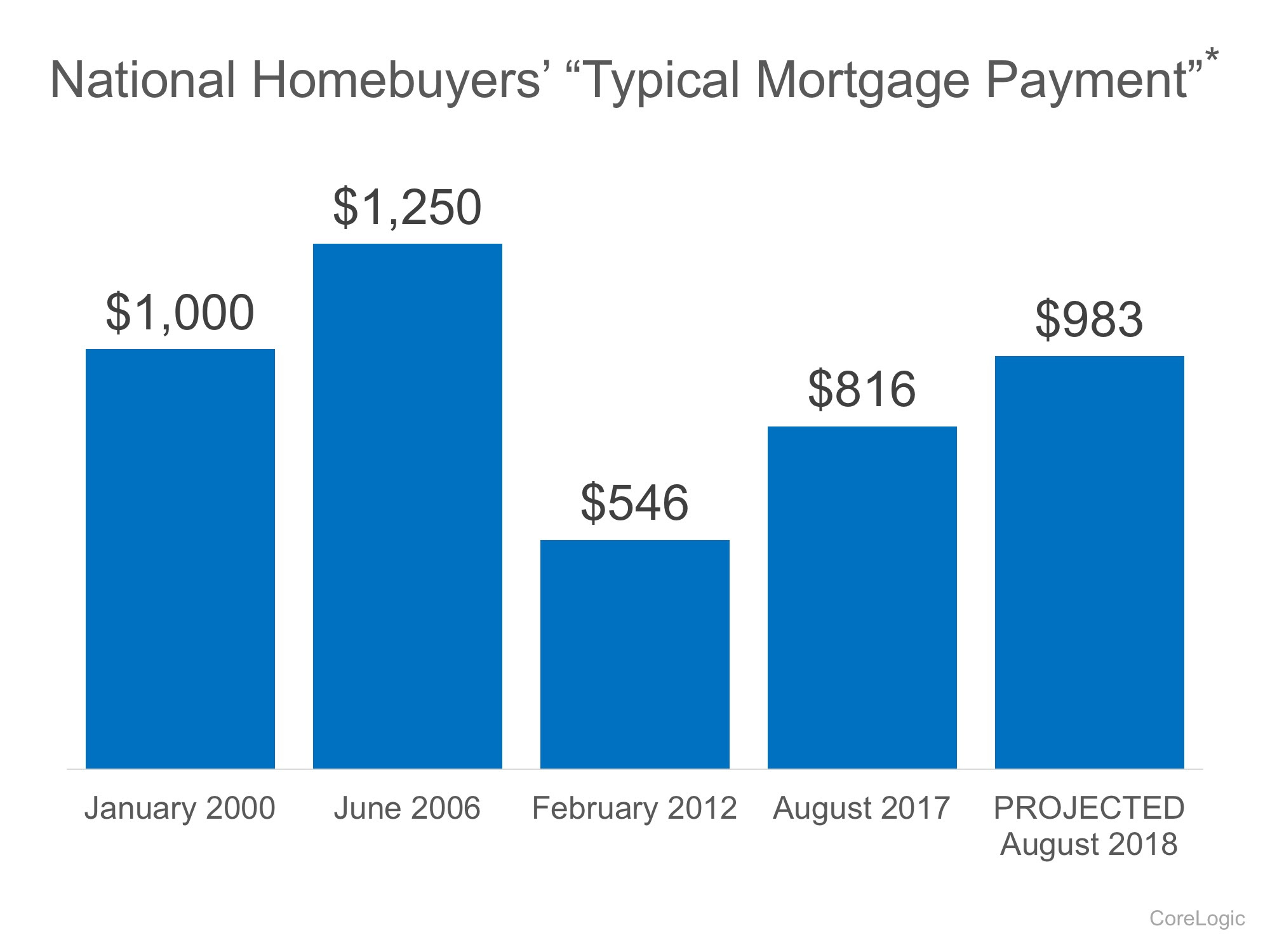

We can see that affordability is better today than in the fifteen years prior to the boom and bust. CoreLogic just published a report showing the National Homebuyers’ “Typical Mortgage Payment.” Here is a graph of their findings:  It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

Bottom Line

Mark Fleming, Chief Economist at First American, explained it best:

“While borrowing power for the potential home buyer has fallen relative to the low point of 2012, it remains high today and will remain high next year, relative to the long run average. If you don’t want to rent anymore and are considering becoming a homeowner, even if mortgage rates rise next year, your borrowing power will remain strong by historic standards.”

Call Us Now To Sell Your Home…

Office: 909.985.9392 or Text Us: 714.657.6634

More State Atty. Generals are Requesting Stay on Foreclosures

Attorney Generals in three more states have asked banks and mortgage lenders to hold off on foreclosures until an investigation into so-called “robosigners” is completed. Delaware Attorney General Beau Biden has called on three banks to stop foreclosure actions in the...

Owing A Home…Is The American Dream Over…More Americans Are Renting than buying

Over 5Million U.S. Households with Over $1Million to Invest

According to a new survey from Phoenix Marketing International’s Affluent Market Practice, the number of American households with the ability to invest $1 million or more rose 8% in the 12 months ended in June. The survey says there now are 5.55 million U.S....

Fannie Mae Is Giving Home Buyers and Real Estate Agents to SELL REO's

So it seems Fannie Mae is doing all it can to unload its massive quantities of REO inventory. When I say massive, I mean the 129,310 single family bank-owned properties — or REOs, as they're called — it held at the end of Q2, which is more than twice what it was...

Home Prices Down…More Short Sales to Come

Ally Financial legal issue with foreclosures may affect other mortgage companies

Some of the nation's largest mortgage companies used a single document processor who said he signed off on foreclosures without having read the paperwork - an admission that may open the door for homeowners across the country to challenge foreclosure proceedings. The...

Dinah Shores Mid-Century Palm Springs Home…asking $5,995,000

The Palm Springs “tennis estate” once owned by the late singer/TV personality Dinah Shore is on the market for $5,995,000. But, for anyone who knows anything about Dinah, putting the sport “tennis” next to Shore’s name — even if it is just real estate marketing for...

Housing Starts Up-But For Multi Family Units…Foreclosed Homeowners Need Housing

What Homeowners Want to Hear About Foreclosure From President Obama

An "A" for Russian Billionaire Andrey Melnichenko…and A Buying Some Strand in Venice, CA?

It appears that Fertilizer King, Melnichenko had his colossal yacht "A" parked off the LA Coastline with many rumors that he was buying up the zany Venice Beach Boardwalk. "A" is reported to be 394' in length...imagine, 1 and 1/3 football fields long and a cost of...

Housing Double Dip…More Foreclosures…Short Sales…President Obama

I'm not sure if it's politics alone or the politics of economic prediction, but I'm seeing an awful lot of "revised" housing expectations as we head into fall. Just this week Fannie Mae put out its "Economics and Mortgage Market Analysis" for September. Chief...

Home Foreclosures…Is the Worst Yet To Come?

Our Most Frequently Asked Question: "What is a Short Sale?"

What is a short sale: A Real Estate short sale occurs when the homeowner sells the house for less money than is owed on the mortgage. In order to conduct a short sale, the seller needs the permission of their lender. The shortfall between the sale price and the value...

Chelsea Clinton Wedding and Astor Court = Dropped Asking Price

"Ex-President Clinton's daughter got married here" just doesn't have the cachet of "Washington slept here." A real estate broker who upped the price of historic Astor Courts in Rhinebeck by $1 million after Chelsea Clinton held her wedding there has now cut the price...

H.R. 6133 – Prompt Decision for Qualification of Short Sale Act of 2010

This is breaking news from REO Insider...and great news at that...It appears that we will see some greater support in the form of actual Short Sale Laws from our government...Limiting the time a bank can respond to a short sale request from it's borrowers... Rep....

Notice Of Defaults Delayed As Banks Deal With Foreclosures

I'm sure you've all seen the headlines from RealtyTrac today that show a new record for bank repossessions. In some of the news reports today, I've also heard TV anchors make mention of some bright news in the report, that Notices of Defaults (NOD's) are down 30...

NAR Report and CoreLogics Index Show Home Price Declines are Just Beginning; More Short Sales!

Check this out... National Association of Realtor's (NAR) Report: Residential Home Sales Down 27+% Sales at lowest level since 1999 Housing Inventory went up 2.5% 12.5 Months of Housing Inventory...just below record numbers of 12.9 Months CoreLogic Report: 36 States...

Bank Foreclosures Set New Record In August…

Well, we certainly have felt the squeeze from major lenders NOT extending trustee sales...even in our active short sales... The reason comes as no surprise, as banks have allowed homeowners to "live rent free" due to the mass amount of homes mortgages that are in...