Charts Don’t Lie About Housing Affordability

These Charts Don’t Lie About Housing Affordability! There’s a lot of discussion about the current state of housing affordability for both first-time and move-up buyers. Much of the narrative is tarnished with a negative slant. However, the truth is that housing affordability is better today than at almost any time in our history.

The naysayers are correct that affordability today is not as good as it has been over the last several years. But, we must remember that home prices collapsed during the housing crash, and distressed properties (foreclosures and short sales) kept home values depressed for years. When we compare affordability to the decades that proceeded the crash, a different story is revealed.

Here is a graph of the National Association of Realtors’ Housing Affordability Index. The higher the graph, the more affordable homes are.

Charts Don’t Lie About Housing Affordability

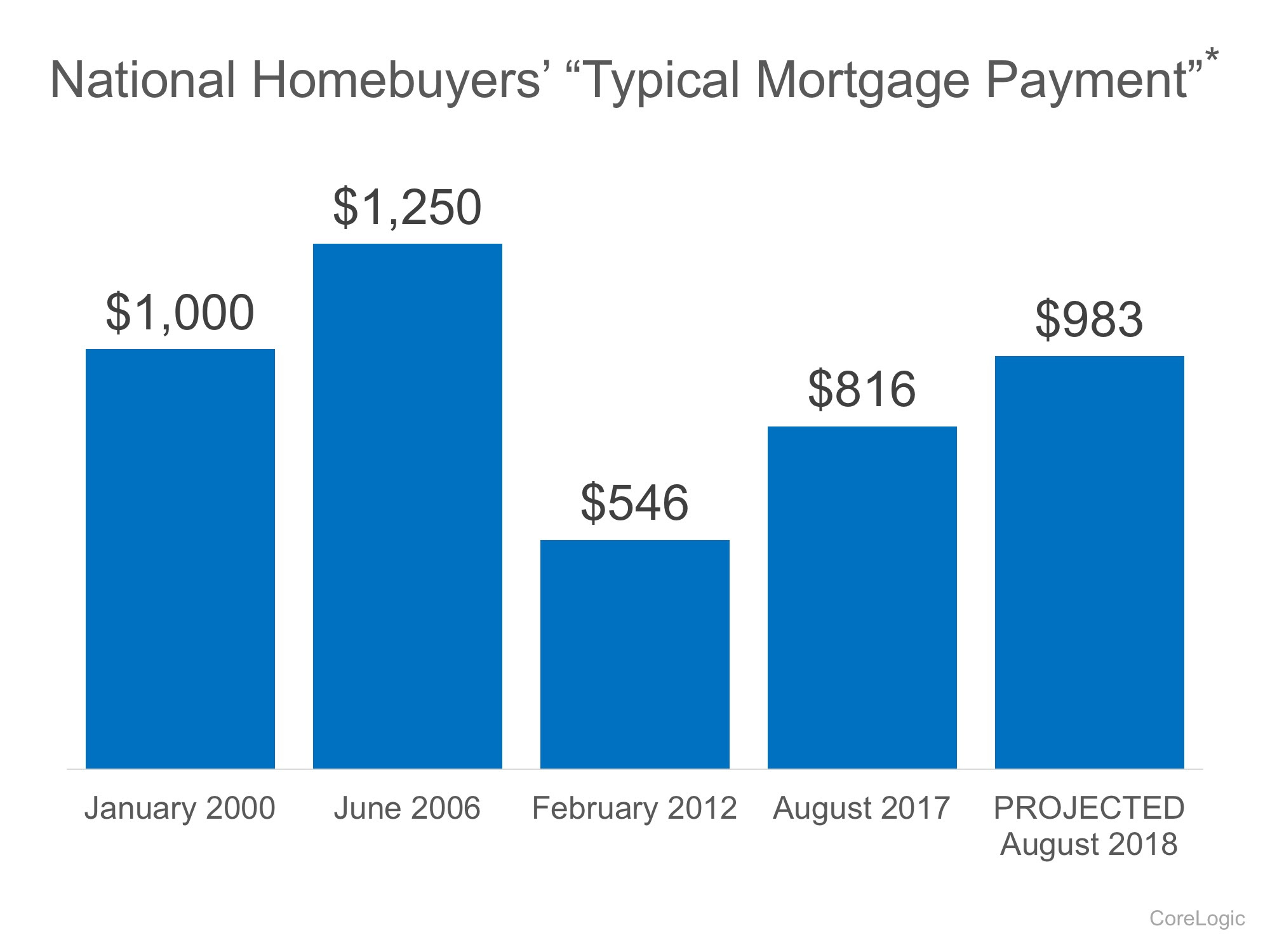

We can see that affordability is better today than in the fifteen years prior to the boom and bust. CoreLogic just published a report showing the National Homebuyers’ “Typical Mortgage Payment.” Here is a graph of their findings:  It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

Bottom Line

Mark Fleming, Chief Economist at First American, explained it best:

“While borrowing power for the potential home buyer has fallen relative to the low point of 2012, it remains high today and will remain high next year, relative to the long run average. If you don’t want to rent anymore and are considering becoming a homeowner, even if mortgage rates rise next year, your borrowing power will remain strong by historic standards.”

Call Us Now To Sell Your Home…

Office: 909.985.9392 or Text Us: 714.657.6634

Senate Approves Fiscal Cliff and Includes Extension of the Mortgage Debt Tax Relief for Short Sales

Early this New Years morning, the Senate approved the budget to "avoid" the fiscal cliff that would have lead Americans into a financial tizzy. As long as the House votes this in, we're all good. Meaning? If you sell your home for less than what you owe, Short Sale,...

3 Government Programs That Help Distressed Homeowners

Housing Preservation Foundation The Housing Preservation Foundation has a website that provides information on the foreclosure process. Distressed homeowners can log into a 24-hour online chat session to connect with a housing counselor. The counselor can help the...

10 THINGS YOU SHOULD NEVER DO IF YOU FALL BEHIND ON A MORTGAGE PAYMENT

10 THINGS YOU SHOULD NEVER DO IF YOU FALL BEHIND ON A MORTGAGE PAYMENT If you are a homeowner having trouble paying your mortgage please know that you are not alone! There are tens of thousands of property owners across the United States who have missed their payments...

California Program Gives Money to Homeowners in Need During Short Sale Process

California Homeowners need money for moving after a short sale try “TAP”

Notre Dame BCS Ranked #1…Congratulations!

11 Straight Wins! A Little plug for the Alma Mater: With the losses of Oregon and Kansas State, mayhem has now ensued at the top of the BCS standings, and the national title picture is officially wide open. Notre Dame has the inside track to reach the national title...

Bank of America Closing More Short Sales to Fulfill Legal Woes

This just broke from USA Today... BofA admits that it is fulfilling it's obligation of Billions owed in legal penalties to the US Government and the families it damaged for its malfeasance in the collapse of the housing market. Read on... By Kris & Kim Darney...

Our Riverside Short Sale Nightmare…Press Enterprise’s Dan Bernstein Helps Out!

One of our listings in Riverside County has been under the scrutiny of the Riverside Press Enterprises Award Winning Columnist, Dan Bernstein. Our client has been the victim of State wide cuts in both area of employment (works for a local school district that made...

Fannie Mae Streamlines Short Sales Even More!

Announced today... Fannie Mae. the government agency that backs millions of home mortgages announced that it is delegating authority to it's mortgage backed servicers and banks to make quick decisions as it pertains to short sales and not having to seek Fannie Mae...

FREE California Short Sale Legal Advice

Free Online Short Sale Legal Assistance http://www.avvo.com Do you get what you pay for? That is yet to be determined. By Kris and Kim Darney

Short Sales Preferred over Foreclosure by California Homeowners

The latest results are in... California Association of Realtors states that Short Sales Reach and all time high in September 2012. number 24.3%. Real Estate Owned (Foreclosures) fell to 12.3% By Kris and Kim Darney READ THSI ARTICLE by DS News.com While distressed...

Housing Worse off Now Than in 2008…More Short Sales Needed?

We have seen a massive decline in home values resulting in the worse housing market on record. Signs from a recent report from RealtyTrac show that housing prices are stabilizing however, that many communities are struggling with high unemployment that is affecting...

We Can Accomplish Anything When We Want to…

Red Bull Stratos, MACH 1.24, Supersonic,FELIX BAUMGARTNER, 834 miles per hour

OCWEN Buys Homeward Residential Holdings and 422,000 Mortgage Loans

Ocwen Financial Corporation ($28.96 0%) will buy Homeward Residential Holdings from private equity firm WL Ross & Co. for around $750 million total. Homeward Residential Holdings is a mortgage servicing and origination business. The deal is equal to approximately...

Homeowners with 2nd’s with Bank of America May be eligible to Have Them Be Expunged!

Borrowers with second liens owned and serviced by Bank of America ($8.93 -0.03%) may qualify to get their subordinate debt extinguished entirely. The banking giant mailed 150,000 letters to pre-qualified homeowners who are eligible to have their Bank of America...

In-N-Out Heiress Lynsi Martinez Spends $17 Million on Bradbury Digs

Not sure if her parents would approve... Mz. Martinez, the ordained head of the best hamburger int he Free World, In-N-Out is blowing through her wad of cash buying lavish homes throughout the LA Basin...including 2 mansions in neighboring Glendora (my home town and...

California Home Prices Up! More Short Sales

Declining inventory helps explain why the statewide median price of an existing, single-family detached home rose to $343,820 in August, up 3 percent from July and up 15.5 percent from August 2011, according to C.A.R.

Home Prices Rise in August 16% Year over Year…More Short Sales

Existing home sales and home prices both improved in August, with sales rising 7.8 percent on a seasonally adjusted annual basis. According to information released this morning by the National Association of Realtors® (NAR) August was the sixth consecutive month for...

Fewer Mortgage Defaults For the 8th Straight Month

First mortgages defaulted at a 1.4% rate in August, down from 1.92% one year ago, according to S&P and Experian. Fewer borrowers defaulted on their first mortgage than for the eighth straight month, according to consumer credit data from Standard &...