Charts Don’t Lie About Housing Affordability

These Charts Don’t Lie About Housing Affordability! There’s a lot of discussion about the current state of housing affordability for both first-time and move-up buyers. Much of the narrative is tarnished with a negative slant. However, the truth is that housing affordability is better today than at almost any time in our history.

The naysayers are correct that affordability today is not as good as it has been over the last several years. But, we must remember that home prices collapsed during the housing crash, and distressed properties (foreclosures and short sales) kept home values depressed for years. When we compare affordability to the decades that proceeded the crash, a different story is revealed.

Here is a graph of the National Association of Realtors’ Housing Affordability Index. The higher the graph, the more affordable homes are.

Charts Don’t Lie About Housing Affordability

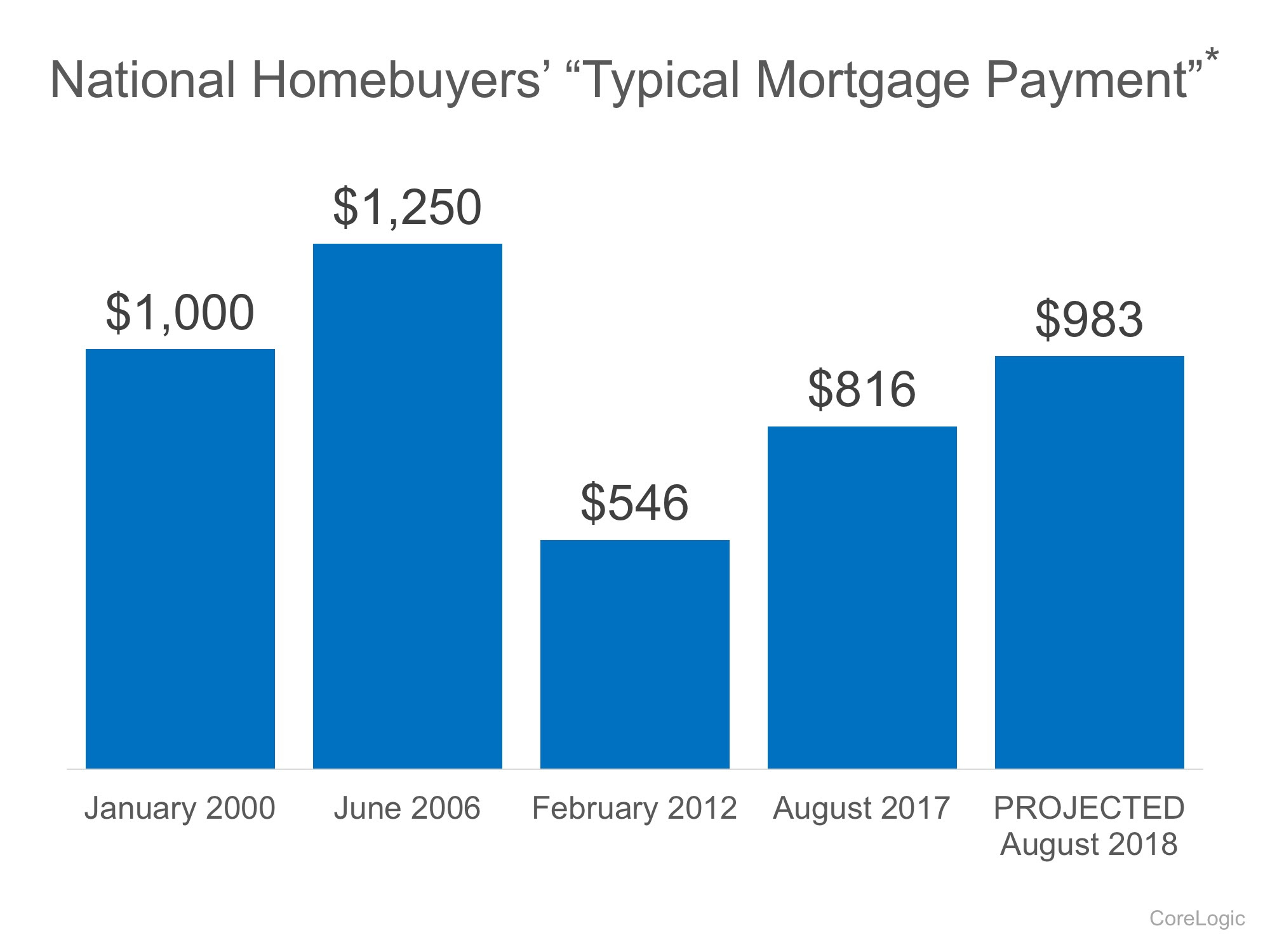

We can see that affordability is better today than in the fifteen years prior to the boom and bust. CoreLogic just published a report showing the National Homebuyers’ “Typical Mortgage Payment.” Here is a graph of their findings:  It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

It reveals that, though a ‘typical’ housing payment was less expensive in 2012 (remember distressed properties), it is currently less expensive than it was in 2000 and is still projected to be lower next year than it was in 2000.

Bottom Line

Mark Fleming, Chief Economist at First American, explained it best:

“While borrowing power for the potential home buyer has fallen relative to the low point of 2012, it remains high today and will remain high next year, relative to the long run average. If you don’t want to rent anymore and are considering becoming a homeowner, even if mortgage rates rise next year, your borrowing power will remain strong by historic standards.”

Call Us Now To Sell Your Home…

Office: 909.985.9392 or Text Us: 714.657.6634

Los Angeles County Real Estate Statistics for March 2014

March 2014 Real Estate Activity Statistics for Los Angeles County: Total Single Family Residence (SFR) Sold/Closed: 3,634 Total SFR Distressed Sales (NOD, In-Forclosure, Short Sale) 326 Total Real Estate Owned (REO) 136 Total Probate 75 Fun Fact: Most Expensive Los...

Mortgage Debt Forgiveness Relief Act Extension Approved by Senate

Great news from NAR on the government approving an extension to the Mortgage Debt Forgiveness Relief Act of 2007.

The Mortgage Debt Forgiveness Relief Act protects the homeowner from taxation on their short sale of their primary residence.

Of course, California residents are protected from this type of taxation under CCP580E.

Chino Hills Housing Statistics

Chino hills California current housing statistics. Is it time to sell?

What is Probate?

What is probate? We answer this question here: https://shortsalesellit.com/probate-questions/ We invite your specific questions Probate, Guardianship or Conservatorship...

Paint Your Home! What To Consider When Choosing A Color.

While it’s a good idea to get creative, it’s usually a bad idea to pick colors that will clash with your neighbors’ exteriors. You can always stand out but try to do so in an unobtrusive way!

The Real Wolf of Wall Street Finally Gets Punished!

It’s about time! Former CEO of Bank of America Ken D. Lewis is given his “sentence” for instrumenting the greatest financial crisis in US history. 5 years after leaving BofA on his Platinum Parachute ($135,000,000.00) “retirement” package, the smoke has cleared?

A Tiny House is not always cheap house…Like Short Sale is not really quick!

We have several friends that are considering downsizing. Who really needs all that "stuff" anyway? Check this out! With high rents in several parts of the country, it’s not uncommon to find apartments measuring under 500 square feet. According to tiny housing...

HAMP Loan Mod Re-Refaults on the Rise!

Loan Mod re-defaults are on the rise across the US. This map is expected to see an increase of 30% loan mod failure. Do you need help?

Suspicious? JPMorgan CHASE Executives are Turning Up Dead

We're not big conspiracy theorists, however, this is right out of a crime novel. Why has this not made the evening news? JP Morgan admitting knowing all about and supporting Bernie Madoff's scheme...what else are they hiding? Below is an article scraped from Housing...

The Types of People That Attend Open Houses

1. The real buyer

These people are somewhere in the home-buying process. They’re either testing out the market or they’re serious and fully qualified, ready to take action. For the seller, these are the ones you want coming through the door.

Why Do Short Sales Take So Long?

In a short sale, you need the seller’s bank to approve before you can close. Banks require dozens of pages of paperwork to evaluate whether or not to approve a short sale. Since the seller is asking the bank to accept a sale price that’s less than the mortgage amount, the bank needs to verify that a short sale is the right thing to do. Banks want to make sure the seller is indeed unable to stay in the home and can’t afford to pay off the difference between the market value and the bank’s loan amount.

Designer Ed Hardy Asking $3.199M for LA Tudor

According to the Los Angeles Times, the Mid Wilshire area abode was purchased by the creator of the Ed Hardy brand in 2007 for $2.695 million. Since then, Audigier sold his design company for $62 million and made several attempts to lease this 5,400-square-foot property.

Grant Deed vs. Quit Claim Deed

ransferring ownership of a property in California is accomplished via a property deed. There are at least a dozen different standard deeds, all developed over time to address different circumstances. These...

Californians: IRS and CA FTB Confirm No Taxes for Short Sales Due to CCP 580E

It's official according to the California Association of Realtors (CAR). As expected, the announcement earlier this month from the IRS courtesy of CAR and Senator Barbara Boxer, the IRS will consider any short sale taxable shortages (1099) for California homeowners...

Over 40% of all mortgages underwater…Short Sales…Foreclosure…Recovery?

Here it is comes, 2014, just a few weeks away...can you believe it? I find myself wondering what 2014 will bring? With recent numbers released by housing forecasters of over 40% of homeowners with mortgages being underwater I have to ask what is really going...

Do you have a mortgage with Chase Bank? May want to Short Sale Soon

If you have a mortgage thats underwater and Chase holds the note, be on the look out for the loan to be sold to Ocwen or another servicer. November 1st is the date slotted for Chase to unload....so....if you are late on payments there is a very good chance the...

Breaking news: California Short Sales are Not Subject to IRS Tax Deficiencies

California Association of realtors and California Senator Barbara Boxer received a letter from the IRS that clearly spell out the due to California's protective laws for distressed homeowners, that the Internal Revenue Service will not pursue tax deficiencies on short...

Riverside and San Bernardino County Rank in the Top 5 Foreclosure Rates

Among the nation’s 20 largest metro areas, the highest foreclosure rates were in Miami, Tampa, Chicago, Baltimore, and Riverside-San Bernardino, California.