93.9% Of Homes in The US Have Positive Equity

93.9% Of Homes in The US Have Positive Equity. CoreLogic’s latest Equity Report revealed that ninety-one thousand residential properties regained equity in Q1 2017. The outlook for 2017 remains positive as well, as an additional 600 thousand properties will regain equity if home prices rise another 5% this year.

The study also revealed that:

- Roughly 63% of all homeowners have seen their equity increase since Q1 2016

- The average homeowner gained about $14,000 in equity between Q1 2016 and Q1 2017

- Only 1.6% of residential properties are near-negative equity

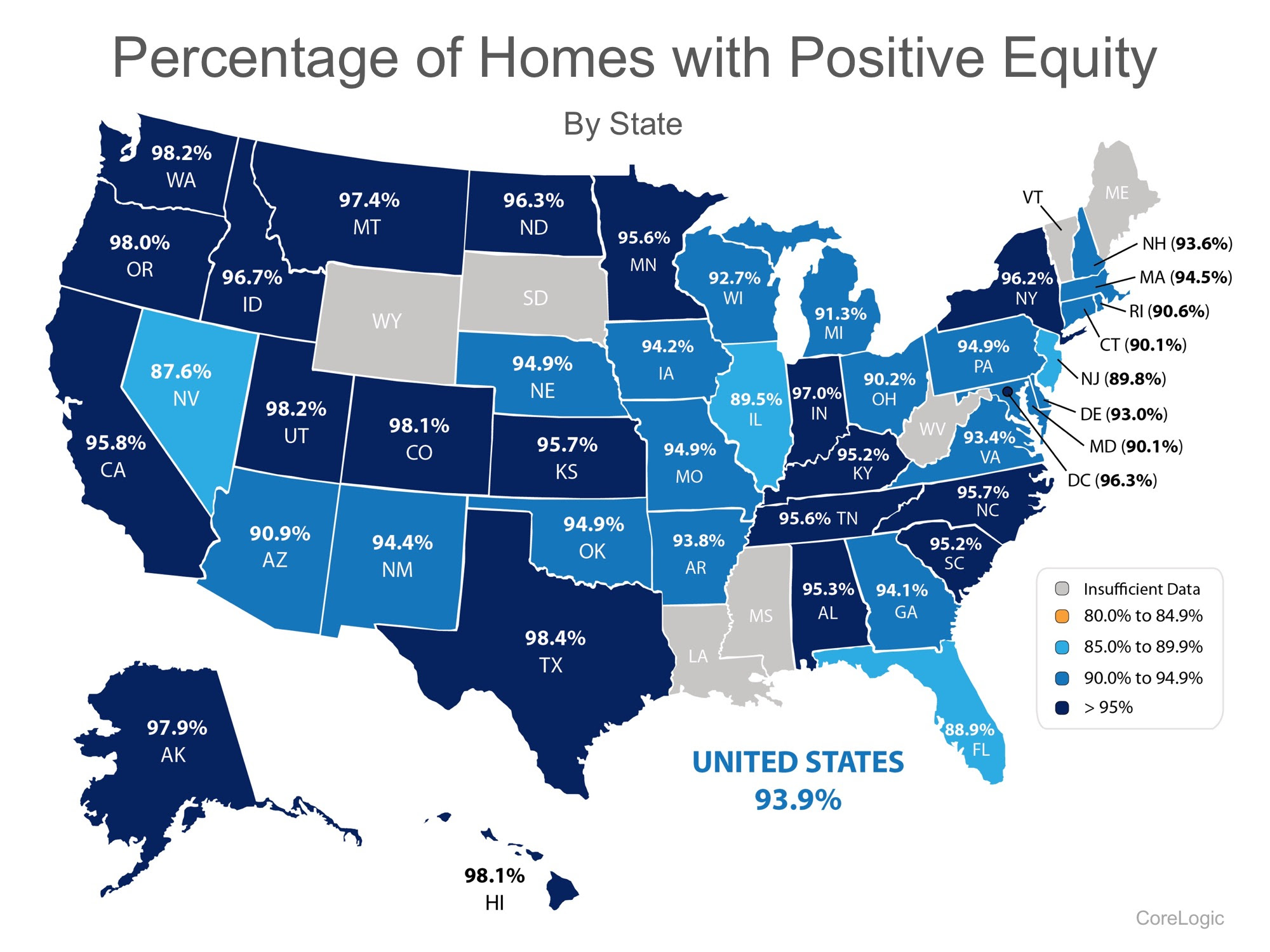

Below is a map showing the percentage of homes with a mortgage, in each state, that have positive equity. (The states in gray have insufficient data to report.)

93.9% Of Homes in The US Have Positive Equity

Significant Equity Is On The Rise

Frank Martell, President & CEO of CoreLogic , believes this is great news for the “long-term health of the U.S. economy.” He went on to say:

“Homeowner equity increased by $766 billion over the last year, the largest increase since Q2 2014. The rising cushion of home equity is one of the main drivers of improved mortgage performance. Since home equity is the largest source of homeowner wealth, the increase in home equity also supports consumer balance sheets, spending and the broader economy.”

93.9% Of Homes in The US Have Positive Equity

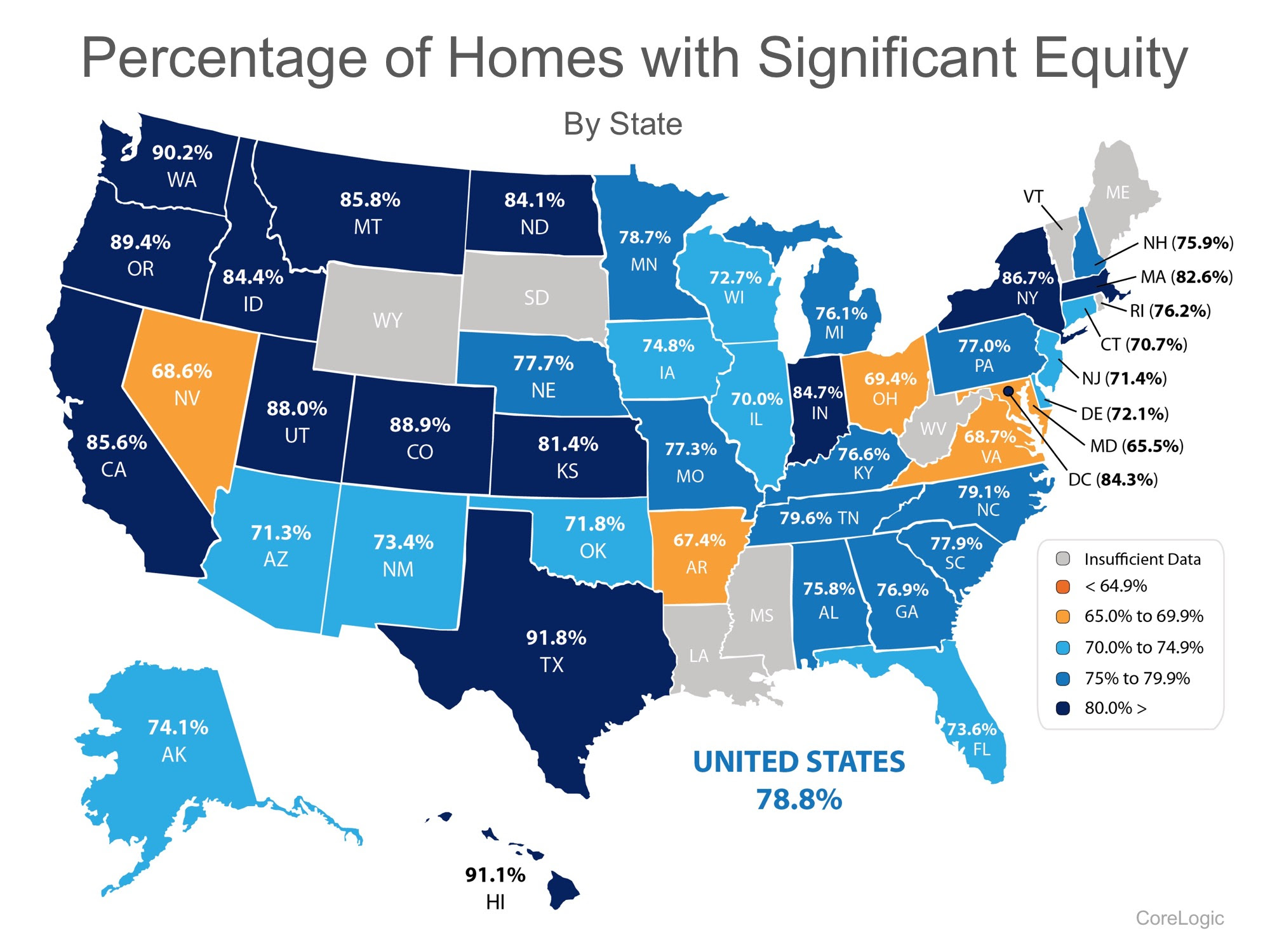

Of the 93.9% of homeowners with positive equity in the US, 78.8% have significant equity (defined as more than 20%). This means that nearly three out of four homeowners with a mortgage could use the equity in their current home to purchase a new home, now .

The map below shows the percentage of homes with a mortgage, in each state, that have significant equity. (The states in gray have insufficient data to report.)

93.9% Of Homes in The US Have Positive Equity

Bottom Line

If you are one of the many homeowners who are unsure of how much equity they have in their homes and are curious about their ability to move, let’s meet up to evaluate your situation.

Call Us Now To Sell Your Home…

Office: 909.985.9392 or Text Us: 714.657.6634

California Residents: 140% or more Underwater…CalHFA to the Rescue

Today, CalHFA announced an exciting new change to their Principal Reduction Program, recognizing aloan-to-value ratio of 140% or higher as a “financial hardship.”

Fannie Mae Finds Fix for Incorrect Credit Reporting of Short Sales…Buy Sooner

Fannie Mae Fixing Their Wrong Credit Reporting for Short Sales

RE Brokers or Agents Not Allowed to Represent Both Seller & Buyer on FHA Short Sale

Housing and Urban Development (HUD) just released updates to Pre-Foreclosure Sales (PFS) or Short Sales for FHA backed mortgages. What does this mean? If you list your FHA backed mortgage for short sale, your listing broker or agent may not represent the buyer as...

Forbes 400 Worth How Much?

According to new research from Forbes, The 400 richest people in the U.S. are now worth a record total of $2 trillion. Entry into this prestigious group starts at a net worth of $1.3 billion, while the average net worth of the group is $5 billion. Topping the 400...

Look Up for Changes!

While ceiling decor might not be the first thing you think about when designing a house, ceilings are a great way to create space or add a focal point. Whether you are dreaming about remodeling a kitchen or an indoor pool, there are endless style options for homeowners looking to add some extra pizazz to the space above their heads.

2.3 Million California Homeowners Are “Almost” or Completely Underwater as of July 2013

Recent numbers place California in the same state of affairs it was just 6 months back! Roughly 6.8 Million SFR mortgages of which 2.3 million are close to or are clearly underwater. A rise in interest rates could throw this number even further into the red…which, is likely to happen over the next few months…above the 5% level! :/

Housing Bubble…Short Sales…Zombie Foreclosures…2014 will be interesting!

Summer Trends Point to another housing bubble

California Short Sale Relocation Program Offers $5,000 to Complete A Short Sale

Great News for those of us in the Golden State.

“There’s Gold in them their short sales!”

Yes…State fo California through CalHFA, is offering up to $5000 to 460 homeowners in CA to complete a short sale successfully.

FHA Back to Work Lending Guidelines: Repurchase 12 Months After Short Sale

What we have been waiting for: FHA announces Re-Purchase Program 12 Months after SHORT SALE.

Eligibility Requirements:

Experienced and Economic Event… (Vague? Most homeowners have been hit with an unforeseen economic hardship)

Must Be Fully Recovered… (You’ve been employed and making money for the last 12 months and your credit reflects your recovery)

Complete HUD Housing Counseling… (Pretty simple…takes an hour or so and you receive a certificate)

Reduction of 20% of your income Due To The Economic Event… (In our experience, this is representative of 90% of the homeowners that have short sold their homes)

Homeowners… are you Distressed Out? Listen & Hear!

Our latest podcast with Larry Bass... ForeclosureAnswerMan.com out of Colorado. Listen, Learn and share with your friends and family in need:

FHA Breaking News…Buy a Home 12 months after Short Sale

Fantastic news from FHA. Just released, If you completed a short sale and it's been over 12 months, you may qualify for a new mortgage loan! Easy guidelines to meet, if you had a hardship, then simply have the documentation to back it up. The Federal Housing...

HAFA Short Sale Extended Through December 31, 2015

Breaking News: Just announced today... Government sponsored Making Homes Affordable HAMP and HAFA programs have been extended through December 31, 2015. Here is the Supplemental Directive 13-04 announcing: sd1304

HAMP and HARP Gets Extended for an Additional 2 Years…More Short Sales

Great News! 2 of the governments distressed homeowners assistance programs have been extended for an additional 2 years, through December 2015. The HAMP program floundered at first, however, with governmental pressures on the banks and services, to promote the HAMP...

Shadow Inventory…Short Sales…FHA…Wow!

Take a minute or two and read this article! Make sure to pay special attention to the new "servicer" requirements on these bad loans once repurchased. Servicers must be purchasing at some extraordinary prices to agree to hold the home from foreclosure for a minimum...

Wells Fargo…Current Spike in Home Prices…”Bubble within a Bust”, More Short Sales

By now you've probably heard that home prices are rising...at high rates, some even cracking the double digit rates! Ask yourself, How and Why? Easy answer...the banks (servicers) are at it again. By not pursuing foreclosure process on homeowners that don't pay, the...

Jane Armstrong, Las Vegas Broker Highlighted on CNBC Power House

Jane Armstrong, one of our Short Sale Graduate Students with Harris University... Congratulations for this great expose' on CNBC and sharing your inside knowledge...watch this video...

Fannie Mae Forcing Foreclsoure to Make More Money…Short Sale Sabotage?

Just reported today from We The People.com... It appears that Fannie Mae, the Government Subsidized Entity (GSE) is gouging homeowners in trouble with a standardized decree to request a minimum of 20% more than market value...on their Fannie Mae backed short sales....

California Homeowners: Changes to Laws on Foreclosure…Short Sale is the Answer!

California Court of Appeals (4th District) overturned CCP 580d as it pertains to protecting homeowners that choose foreclosure over Short Sale. California law "protected" homeowners that chose foreclosure as an alternative if the lenders that were foreclosed on 1st...